Table of Contents

Summarize and analyze this article with

Introduction

Legacy system modernization has become one of the most urgent priorities in global banking. Many institutions still rely on outdated core systems that power deposits, loans, payments, compliance, and risk operations. These systems worked well for decades, but they now create operational risk, security gaps, and expensive maintenance cycles. They also slow down banking digital transformation, which is critical for competitive growth in 2026 and the coming years.

A recent 2025 Accenture study found that banks spend nearly 40% of their IT budgets on maintaining legacy platforms. Another global report by McKinsey predicts that by 2026, banks that fail to modernize will face up to 60% higher operational risk exposure compared to institutions that adopt modular and cloud based architectures.

This blog explains the pitfalls banks commonly face, the strategies that prevent losses, and the modernization approaches that create long-term resilience.

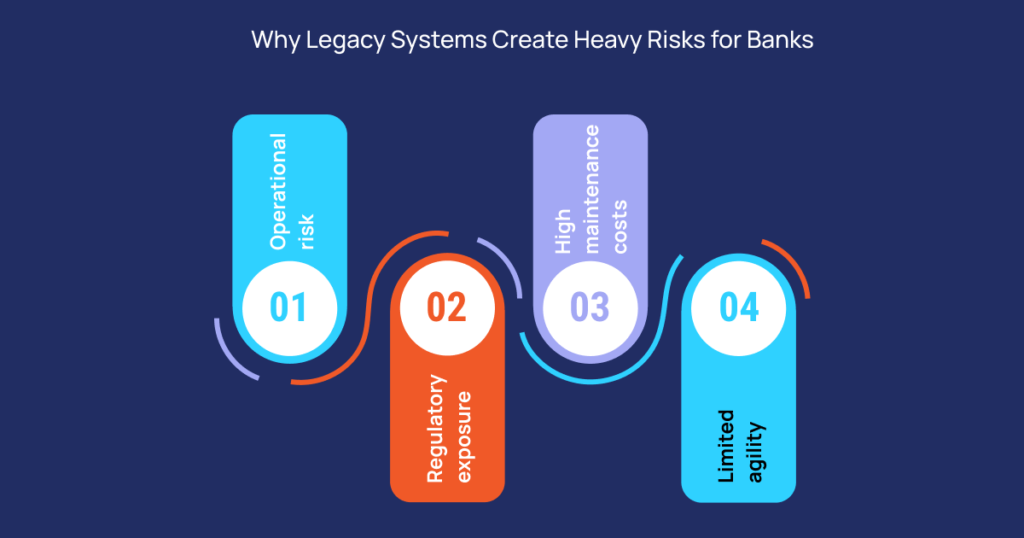

Why Legacy Systems Create Heavy Risks for Banks

- Operational risk: Old systems fail without warning. Even a short outage can cause significant financial penalties and customer loss.

- Regulatory exposure: Regulatory compliance in banking has become stricter than ever. Legacy systems make it difficult to meet real time reporting, audit trails and data security requirements.

- High maintenance costs: Banks often maintain several overlapping applications because core systems cannot integrate with new digital products.

- Limited agility: Innovation slows down when development teams cannot update core components quickly.

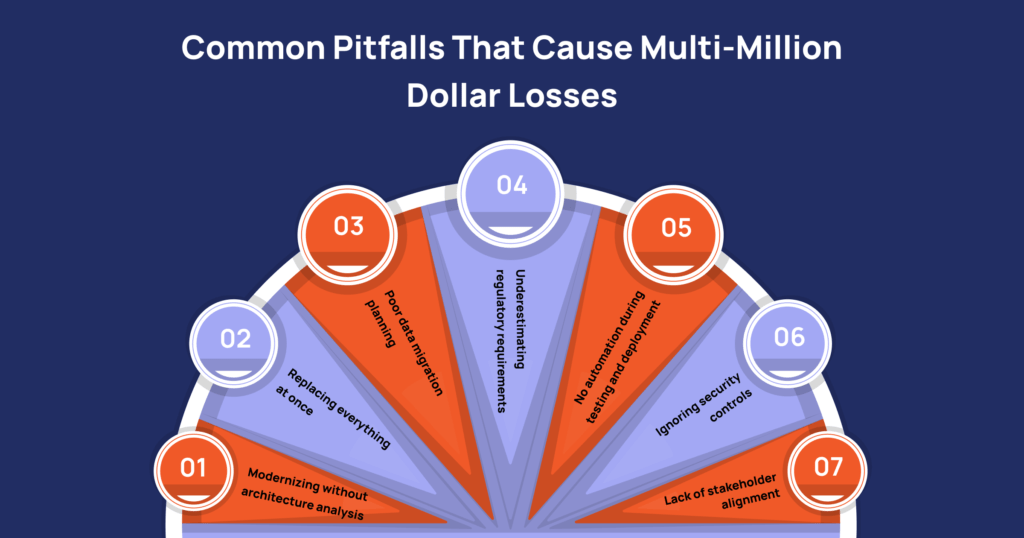

Common Pitfalls That Cause Multi-Million Dollar Losses

1. Modernizing without architecture analysis

Many banks start projects without assessing dependencies, data flows, and custom integrations. This leads to failures during migration and rollout. Architecture-driven modernization avoids this problem by mapping every component before any changes begin.

2. Replacing everything at once

A revolutionary modernization approach seems fast but often creates the highest failure rate. Incremental modernization in banking reduces risk because upgrades happen in small, controlled phases.

3. Poor data migration planning

Legacy banking systems store decades of structured and unstructured data. When banks do not validate data or clean it before migration, the result is corrupted records, failed transactions, and inaccurate reporting.

4. Underestimating regulatory requirements

Regulatory compliance legacy systems need updates that meet KYC, AML, fraud monitoring, and data residency laws. Failure to consider these leads to large penalties and public scrutiny.

5. No automation during testing and deployment

Manual testing extends delivery timelines and increases errors. Core banking modernization needs automated testing, automated orchestration, and automated deployment pipelines to catch issues early.

6. Ignoring security controls

Legacy system risks become severe during modernization because migration windows can expose data. Banks must adopt zero trust security, full encryption and access controls throughout the modernization journey.

7. Lack of stakeholder alignment

A Risk-Aware, Phased Strategy That Actually Works

Step 1. Assess the core

Step 2. Create a modernization blueprint

This roadmap defines workstreams, timelines, data migration logic, and risk controls. It covers banking core system reengineering, business continuity, and phased rollout plans.

Step 3. Use automation and AI to reduce errors

Step 4. Migrate to the cloud in controlled stages

Step 5. Integrate compliance from the beginning

Step 6. Enable continuous modernization

Modernization is not a one-time project. Banks that shift to modular architectures keep improving components without disruption.

How Modernization Improves Banking in 2026

- Higher agility: New features roll out faster. Teams innovate without worrying about legacy limitations.

- Improved system reliability:Modern systems cut outage risk, reduce support calls, and increase transaction accuracy.

- Lower operational costs:Cloud native components reduce hardware and maintenance costs.

- Stronger compliance: Modernized systems follow updated data governance and reporting standards.

- Better customer experienceCustomers receive faster services, better digital journeys, and consistent performance across channels.

Conclusion

Banks should adopt a phased, risk-aware legacy system modernization strategy that uses automation, AI, and cloud technologies. This approach reduces operational risk, improves compliance, and protects banks from the legacy system pitfalls that typically cause financial losses. Pitech supports this model with modern engineering practices, domain expertise, and outcome-driven execution.

Transform your bank’s banking legacy system and accelerate core banking modernization with Pitech’s architecture-driven, defense-grade security and risk-controlled modernization approach.

Key Takeaways

- Legacy systems drain up to 40% of banking IT budgets and increase operational risk significantly.

- Most modernization failures occur due to missing architecture analysis, poor planning, and rushed execution.

- Incremental, phased modernization reduces outages, migration failures, and multi-million-dollar losses.

- Clean, validated, regulation-ready data migration is essential to avoid reporting errors and compliance penalties.

- Automation and AI-driven pipelines dramatically cut defects, delays, and deployment risks in core modernization.

- Modern cloud-native, modular architectures boost resilience, agility, compliance, and customer experience.

Frequently Asked Questions (FAQs)

How do banks decide what legacy components to modernize vs. keep for cost vs. risk management?

Banks use architecture assessments, dependency mapping, and tech debt analysis to evaluate every component. Systems that are high-risk, costly to maintain, or limit compliance are prioritized for modernization. Components that are stable, low-risk, or still delivering value may be retained or re-engineered instead of fully replaced. The decision is based on a risk–cost–business impact comparison.

How do banks handle regulatory and security challenges during legacy system modernization?

What are the common pitfalls banks face that lead to millions in losses during modernization?

Major pitfalls include:

- Starting modernization without architecture or dependency analysis

- Attempting to replace everything at once

- Poor or unvalidated data migration

- Ignoring regulatory requirements

- Relying on manual testing instead of automated pipelines

- Weak security controls during migration windows

- Lack of stakeholder alignment across risk, compliance, operations, and IT