Table of Contents

Summarize and analyze this article with

Introduction

Bank mergers and acquisitions(M&A) are no longer driven solely by balance sheets and branch networks. Today, technology integration, especially cloud migration defines the success or failure of a merger. Industry research shows that 60–70% of bank mergers fail to realise their expected synergies, with IT integration cited as one of the most common reasons. As banks consolidate systems, customers, and operations, cloud platforms promise scalability, resilience, and faster transformation.

However, cloud migration during bank mergers introduces unique risks related to cost, governance, compliance, and data integrity. Studies indicate that technology integration accounts for nearly 40% of post-merger delays in financial services. Many financial institutions underestimate the complexity involved. This blog explores cloud migration best practices during bank mergers, drawing from real industry lessons to help banks avoid costly missteps and ensure a stable post-merger cloud environment.secure cloud solutions for banks

Why Cloud Migration is Crucial in Bank Mergers

- Faster banking IT integration

- Scalability to support larger customer bases

- Improved disaster recovery and resilience

- Modern digital banking capabilities

The Two Things Banks Commonly Get Wrong about Cloud Migration

1. Underestimating the True Cost of Cloud Migration

One of the biggest misconceptions is that cloud migration automatically reduces costs. In reality, cloud migration during bank mergers often exceeds initial budgets by 20–30%, especially in the early phases. These overruns are rarely caused by cloud pricing alone, but by structural and operational complexities unique to merger scenarios.

Hidden cost drivers include:

- Complex application dependencies across merged systems

- Re-architecting legacy platforms not designed for the cloud

- Regulatory re-validation and compliance migration

- Parallel environments running longer than expected

- External consultants filling internal skill gaps

2. Mismanaging Cloud Migration Due to Skills and Governance Gaps

- Limited in-house cloud engineering experience

- Poor coordination between multiple system integrators

- Unclear ownership of migration decisions

- Knowledge gaps around legacy infrastructure

Key Challenges in Cloud Migration Bank Mergers

Data Migration and Integrity Risks

Mergers involve massive volumes of historical financial data. Merger data migration must ensure accuracy, lineage, and auditability.

Risks include:

- Duplicate customer records

- Inconsistent transaction histories

- Data loss during transformation

Security and Compliance Complexity

Banks must maintain secure cloud banking practices while meeting regulatory obligations.

Challenges include:

- Conflicting compliance requirements between entities

- Data residency and sovereignty rules

- Identity and access management inconsistencies

A compliance-first approach is essential for compliance cloud finance initiatives.

Downtime and Customer Experience

- Core banking services

- Digital and mobile banking platforms

- Payment and settlement systems

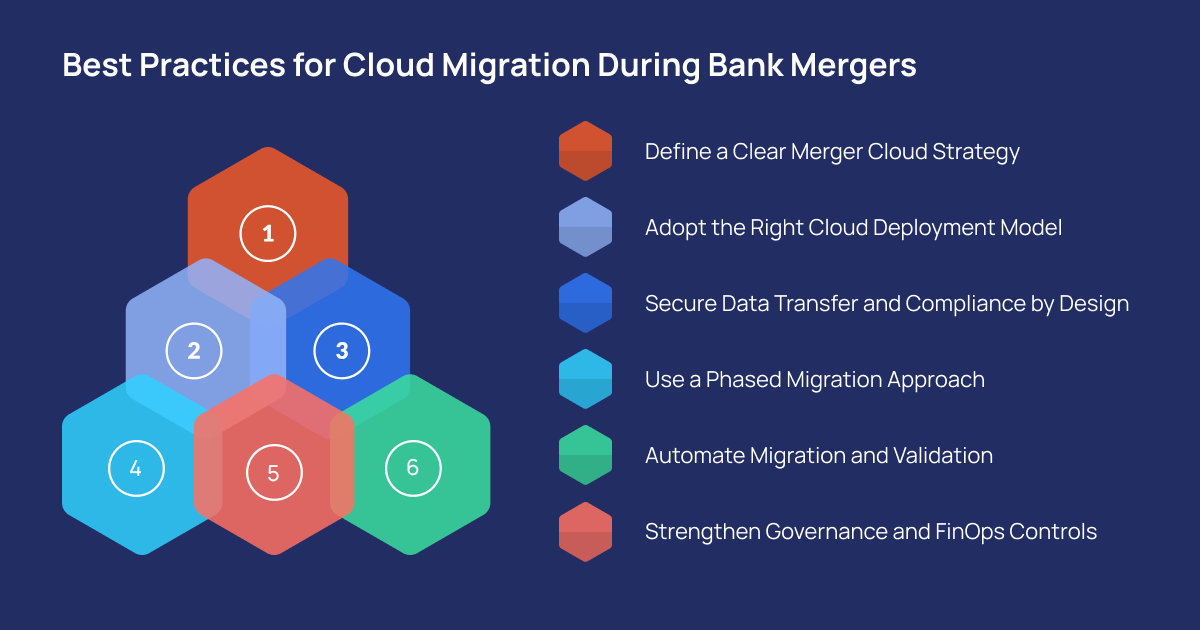

Best Practices for Cloud Migration During Bank Mergers

1. Define a Clear Merger Cloud Strategy

Every successful migration begins with a unified merger cloud strategy.

Banks should:

- Identify the system of record early

- Align cloud goals with merger timelines

- Decide what to modernise, retain, or retire

2. Adopt the Right Cloud Deployment Model

Most banks benefit from hybrid cloud mergers, combining public and private cloud environments.

- Sensitive workloads remain controlled

- Customer-facing platforms gain scalability

- Regulatory flexibility is preserved

3. Secure Data Transfer and Compliance by Design

Security must be embedded into every stage of migration.

Best practices include:

- Encryption for data in transit and at rest

- Zero-trust access models

- Continuous compliance monitoring

This ensures strong financial data security throughout migration.

4. Use a Phased Migration Approach

A staged migration reduces risk and improves stability.

Typical phases:

- Non-critical applications

- Digital banking platforms

- Core banking systems

This approach supports smoother post-merger cloud adoption.

5. Automate Migration and Validation

Automation reduces errors and accelerates timelines.

Automation supports:

- Infrastructure provisioning

- Data reconciliation

- Dependency mapping

- Rollback and recovery

It also helps control costs during compliance migration efforts.

6. Strengthen Governance and FinOps Controls

To avoid cost overruns, banks must implement governance early.

Key actions:

- Establish cloud cost visibility

- Monitor usage continuously

- Decommission legacy systems promptly

Strong governance prevents cloud sprawl during bank mergers.

Managing User Impact During Banking IT Integration

Customer trust must remain intact throughout the transition.

Banks should:

- Migrate during off-peak hours

- Communicate clearly with customers and staff

- Maintain parallel runs where required

- Provide dedicated support during cutover

This minimises disruption and protects brand credibility.

Conclusion

Cloud migration during bank mergers is a complex, high-risk initiative that demands far more than technical execution. Banks that underestimate costs or mismanage governance often face delays, overruns, and operational instability. By adopting a compliance-first approach, investing in internal capabilities, automating migration processes, and executing through phased strategies, banks can turn cloud migration into a competitive advantage. When done right, cloud adoption enables seamless integration, stronger security, and a resilient foundation for long-term growth in the post-merger era.

Key Takeaways

- Cloud migration can make or break a bank merger : It’s no longer just an IT exercise but how well systems are integrated often decides whether a merger actually delivers value.

- Cloud doesn’t automatically mean cheaper: During mergers, costs frequently run 20–30% higher than planned, mainly due to legacy systems, parallel operations, and regulatory rework.

- Lack of ownership causes bigger problems than technology: When banks rely too heavily on vendors without strong internal governance, cloud spend and operational risk quickly spiral.

- Data accuracy, security, and compliance must come first: Even small gaps in data integrity or access controls can create regulatory exposure and long-term trust issues.

- Phased, automated migrations reduce chaos Moving in stages and using automation helps banks avoid outages, limit errors, and keep integration timelines on track.

- Customer experience should never feel the impact : Careful scheduling, clear communication, and parallel system runs ensure customers barely notice the transition.

Frequently Asked Questions (FAQs)

How do you migrate data securely during a bank merger without downtime?

Banks achieve secure data migration during mergers by using parallel system runs and continuous replication instead of one-time cutovers. Data is encrypted in transit and at rest, while legacy and target environments run simultaneously until validation confirms accuracy. Final cutovers are scheduled during off-peak hours to ensure near-zero customer-visible downtime.

What cloud provider is best for compliance in financial mergers?

There is no single best cloud provider for all financial mergers. Compliance depends on how well the cloud architecture aligns with regulatory requirements such as data residency, audit logging, and access controls. Most banks use hybrid or multi-cloud models on platforms like AWS, Microsoft Azure, or Google Cloud Platform, combined with strong governance and compliance-by-design frameworks.

How do you plan cloud migration timelines for merging IT systems?

Cloud migration timelines in bank mergers are planned in phases aligned to business criticality and regulatory approvals. Non-critical systems move first, followed by customer-facing platforms and core banking systems. Timelines include buffers for audits, parallel runs, and regulatory sign-offs, since full integration often continues well after the legal merger closes.

What risks come with cloud-to-cloud migrations post-acquisition?

Cloud-to-cloud migrations introduce risks such as inconsistent IAM models, security misconfigurations, audit trail gaps, and unexpected data egress costs. Differences in logging, encryption standards, and compliance tooling between cloud environments can create regulatory exposure if governance is not unified early.

How do you validate data integrity in GCP during bank cloud shifts?

Data integrity in Google Cloud Platform migrations is validated using automated reconciliation, checksum verification, and transaction matching. Banks compare record counts, balances, and timestamps across source and target systems while maintaining immutable logs to support regulatory audits and traceability.