Table of Contents

Summarize and analyze this article with

Introduction

Why AI in Risk Management is Important

Organizations face larger data volumes and faster threat surfaces. In 2025, many surveys show a sharp rise in enterprise AI adoption, a growing share of use cases are moving into production, and AI risk assessment is no longer optional. Executives must treat AI as both an opportunity and a new risk category requiring its own controls. Key market signals show rapid investment in predictive risk analytics and AI-powered risk dashboards, driven by demand for real-time insight.

Modern risks move faster than manual review cycles. That is why firms are investing in AI risk assessment, anomaly detection, and real-time alerts. These capabilities identify blind spots early, reduce false positives, and cut the time between detection and action.

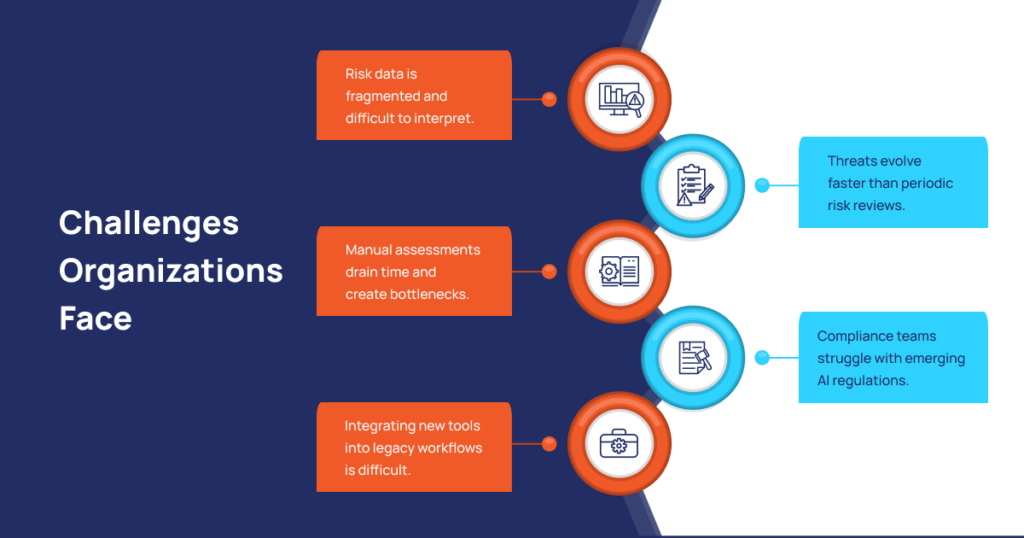

Challenges Organizations Face

-

Risk data is fragmented and difficult to interpret.

- Threats evolve faster than periodic risk reviews.

- Manual assessments drain time and create bottlenecks.

- Compliance teams struggle with emerging AI regulations.

-

Integrating new tools into legacy workflows is difficult.

Core Benefits of AI Risk Management

- Faster risk identification: Machine learning flags anomalies earlier than manual review.

-

Predictive outcomes: Predictive risk analytics forecast trends and probable losses.

- Automation of routine checks: AI risk automation reduces manual workload and error.

-

Decision-grade dashboards: AI-powered risk dashboards provide actionable, real-time views.

Where AI Creates Real Value

1. Predictive Risk Analytics

2. AI Risk Automation

3. AI Risk Governance

4. AI-Powered Risk Dashboards

Real-time dashboards provide visibility into high-priority exposures, compliance gaps, and emerging incidents. Leaders get a single source of truth for decision-making.

These capabilities turn risk management into a dynamic, intelligence-driven function rather than a reactive, checklist-driven obligation.

Practical Use Cases for 2025 & 2026

Fraud & Financial Crime

Operational & Process Risk

AI identifies anomalies in supply chains, employee workflows, and operational processes, preventing downtime and errors.

Third-Party & Vendor Risk

Cyber Risk

Compliance & Regulatory Risk

How to Implement AI the Right Way

- Start with prioritized use cases: Pick 2–3 high-value problems where AI risk management solutions can measurably reduce loss or cost.

- Build a minimum viable governance model: Inventory models, classify risk level, and require explainability for high-risk systems.

- Instrument for continuous monitoring: Deploy AI risk dashboards and anomaly alerts.

-

Automate repetitive controls: Use AI risk automation for routine checks and reporting.

- Measure outcomes: Track detection lead time, false positives, and remediation time. Take a staged approach. Data from enterprise studies shows that only a minority of AI projects reach full production, so the focus should be on scaling the ones that prove ROI.

Governance & Regulation

Common obstacles (and how to overcome them)

-

Data quality and integration: Treat data engineering as the priority.

- Skills gap: Recruit hybrid teams — risk + ML engineers.

- False positives and alerts overload: Tune models and combine automated triage with human review.

- Regulatory uncertainty: Adopt modular governance that can be adjusted as rules evolve.

Metrics that matter (for the executive dashboard)

- Time-to-detection (hours vs. days)

- True positive rate (precision) and false positive reduction

- Remediation cycle time and cost saved

- Percent of prioritized use cases in production and ROI achieved

Track these alongside traditional KRIs to show board-level impact.

Quick start checklist (actions this quarter)

-

Approve 1–2 pilot projects for predictive risk analytics.

- Mandate model inventory and classification.

- Deploy a lightweight AI-powered risk dashboard for CISO/CRO review.

- Require third-party AI vendor risk reviews for any procurement.

Conclusion

AI in risk management isn’t about chasing the latest tech. It’s about using smarter tools to stay ahead of risks that keep changing shape. When paired with strong AI governance, targeted AI risk assessment, and clear metrics, it delivers faster detection, lower operational cost, and stronger compliance. Executives should prioritize pragmatic pilots, instrument outcomes, and scale the wins. The firms that treat AI as both a risk and a control will lead in resilience across 2026 and beyond.

Key Takeaways

- AI helps teams get ahead of risk instead of reacting to it, spotting issues earlier and shortening the gap between detection and action.

- The biggest gains come from a few well-chosen use cases, where predictive analytics and automation clearly reduce loss, effort, or exposure.

- Governance has to move in step with adoption, as regulators expect transparency, accountability, and control across the AI lifecycle.

- Progress works best in stages, with leaders measuring outcomes early and scaling only the initiatives that prove real value.