Table of Contents

Summarize and analyze this article with

Introduction

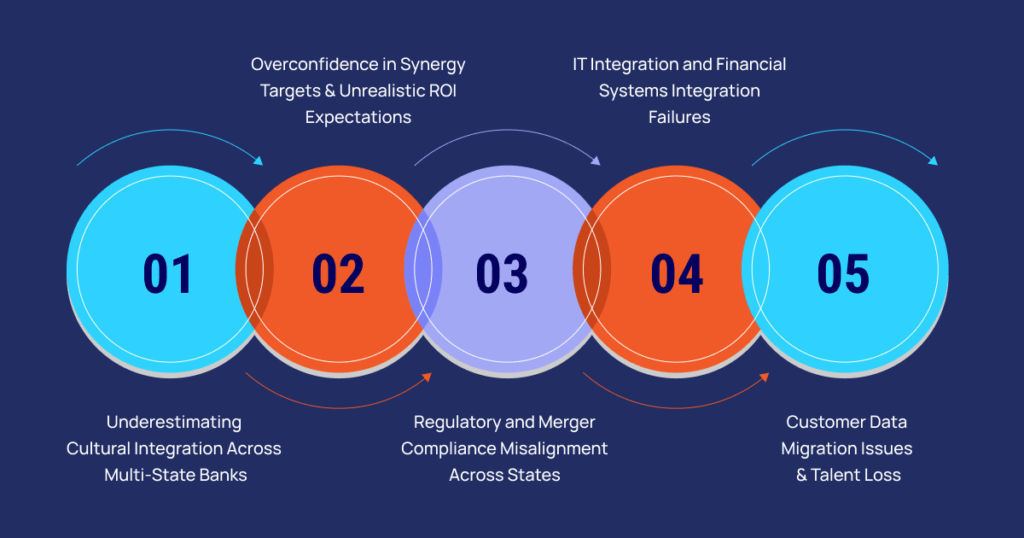

Underestimating Cultural Integration Across Multi-State Banks

Culture misalignment is one of the biggest drivers of bank merger failures, especially when institutions operate in diverse states with different service expectations, workforce norms, and risk appetites. In 2025, McKinsey reported that cultural conflict alone can reduce merger value by up to 30%.

Banks often focus on systems consolidation and regulatory approvals while ignoring frontline behaviors, leadership communication, and decision-making structures. The result: disengaged teams, stalled collaboration, and a fractured workforce.

What Works

-

Build a dedicated cultural integration team aligned with HR, operations, and compliance .

- Map cultural attributes of both banks and define a shared operating model early.

- Use structured change-management programs to keep employees informed and involved.

- Deploy cross-state leadership workshops and onboarding pathways to unify teams.

-

For support in developing integration-aligned platforms and collaboration workflows, see PiTech’s Digital Transformation Services .

Overconfidence in Synergy Targets and Unrealistic ROI Expectations

Common causes:

- Hidden operational complexity

- Loss of key talent

- Delayed system migrations

- Overlapping merger compliance frameworks

- Slow customer migration strategies

What Works

- Build synergy models grounded in operational data, not assumptions.

-

Prioritize quick-win initiatives first (fee harmonization, vendor consolidation .

- Create a synergy tracking office with transparent reporting.

- Stress-test cost-saving plans under regulatory and IT integration constraints.

-

To optimize processes and costs, explore PiTech’s Process Automation Solutions .

Regulatory and Merger Compliance Misalignment Across States

What Works

- Launch a compliance integration office before legal Day 1.

- Harmonize policies across AML/KYC, credit risk, data governance, fair lending, and cybersecurity.

- Map state-by-state requirements and embed them into risk management frameworks.

- Integrate compliance teams directly into IT and operations workstreams to avoid retrofitting controls.

-

For regulatory-aligned data and technology modernization, see PiTech’s Banking & Financial Services Practice .

IT Integration and Financial Systems Integration Failures

Key challenges:

- Complex data migration pathways

- Inconsistent cybersecurity frameworks

- Legacy core banking platforms

- Fragmented customer experience layers

- High integration costs

- Unstable system cutovers

What Works

- Apply a phased integration strategy—start with high-impact systems first.

-

Create a unified architecture blueprint covering IT integration, cybersecurity, cloud, and digital interfaces.

- Conduct early system stress testing and parallel-run simulations.

- Avoid “big bang” migrations unless infrastructure maturity is high.

- Use modern middleware and API gateways to sync legacy platforms safely.

-

For secure and scalable technology integration expertise, explore PiTech’s Cloud & Infrastructure Services and Data Engineering Services .

Customer Data Migration Issues and Talent Loss

What Works

-

Conduct end-to-end data lineage mapping before migration.

- Validate data quality early to avoid downstream failures.

- Apply strong encryption and zero-trust frameworks to protect sensitive customer information.

- Develop retention programs with role clarity, incentives, and cross-state career paths.

-

For secure data migration, governance, and quality frameworks, see PiTech’s Data Quality & Governance Solutions .

How Multi-State Banks Avoid These Pitfalls

-

A strong Integration Management Office with executive sponsorship.

- A prioritized, phased roadmap aligned with compliance and customer experience

-

Early involvement of IT, risk management, compliance, and data experts .

- Clear communication across states and business units

- Measurable KPIs to track synergy realization and operational health

- Faster regulatory approvals

- Reduced system cutover risks

- Lower operational costs

- Higher workforce alignment

- Stronger long-term value creation

Conclusion

Key Takeaways

- Cultural gaps across states can reduce merger value by up to 30%. Alignment and structured change management are essential.

- Only 18–25% of projected synergies typically materialise due to hidden operational and compliance complexities.

- Regulatory divergence across states increases integration risk, making early compliance alignment mandatory.

- 70% of integration failures stem from IT and financial system issues, especially in multi-state environments.

- Data migration errors disrupt customer experience, amplifying financial and operational risk.

- Talent attrition spikes post-merger. Frontline, tech, and compliance teams require clear retention pathways.

- Banks that execute phased, disciplined integration gain faster regulatory approvals and stronger long-term value.

Frequently Asked Questions (FAQs)

What are the biggest challenges in post-M&A integration in banking?

How do multi-state banks handle compliance during merger integrations?

Why do bank mergers fail at the integration stage?

Mergers often fail post-signing due to underestimating cultural differences, overconfident financial projections, regulatory misalignment, IT system failures, and poor talent or customer data management.

What happens to customer data during bank mergers?

Customer data can face errors like duplicate records, account mismatches, or transaction disruptions if data migration is poorly managed. Secure, end-to-end data mapping and validation are critical to prevent these issues.

How to avoid losing key employees after a bank merger?

Banks can retain talent by implementing clear retention programs, defining roles, offering incentives, providing cross-state career paths, and maintaining transparent, frequent communication to reduce uncertainty.