Table of Contents

Summarize and analyze this article with

Introduction

The banking industry stands at a pivotal crossroads. Traditional operational models are buckling under the weight of rising costs, increasingly sophisticated fraud schemes, complex regulatory requirements, and customers who expect instant, personalized service around the clock. The question is no longer whether banks will adopt artificial intelligence, but how quickly and effectively they can embrace AI banking transformation to become AI-first institutions.

This AI banking transformation isn’t about adding a chatbot to your website or automating a few back-office processes. It’s about fundamentally reimagining how banks operate, engage customers, manage risk, and make strategic decisions. The financial institutions that get this right will thrive in the next decade. Those who don’t risk becoming irrelevant.

Understanding the AI Banking Transformation Landscape

The Current State of Banking

Banks today are wrestling with a perfect storm of challenges. Operating costs continue to climb as legacy systems are modernized. Fraud has become more sophisticated, with criminals leveraging technology faster than many institutions can respond. Regulatory compliance grows more complex each year, demanding resources that could otherwise drive innovation. Meanwhile, customers, particularly younger demographics, expect seamless digital experiences that rival what they get from tech companies.

The traditional banking model, built on physical branches and business-hour availability, simply can’t compete in an always-on digital economy. Customers want answers at 2 AM. They want loan approvals in minutes, not days. They want financial advice that understands their unique situation, not generic product pitches.

Why AI Is Different This Time

Financial services have experimented with technology for decades, but AI—particularly large language models and conversational AI—represents something fundamentally different. Unlike previous technology waves that automated specific tasks, AI can understand context, learn from patterns, make nuanced decisions, and interact naturally with humans.

This isn’t just about efficiency. It’s about creating entirely new capabilities that weren’t possible before: real-time fraud detection that adapts to new attack vectors, customer service that truly understands complex financial questions, risk models that process thousands of variables simultaneously, and compliance systems that keep pace with regulatory changes.

The question circulating through banking forums and industry conferences—”How will AI and LLMs reshape the structure and size of the financial industry?”—has a clear answer emerging: dramatically. But the institutions that succeed won’t be those that simply replace humans with machines. There’ll be those who strategically amplify human capabilities while automating what machines do best.

Core Pillars of AI-First Banking

The foundation of an AI-first banking model rests on several core pillars that enable banks to modernize data, automate intelligently, and innovate responsibly while maintaining trust and compliance.

| Pillar | Description |

|---|---|

| Data Modernization | Centralized, AI-ready data architectures enabling consistent insights. |

| Intelligent Automation | Machine learning-driven process orchestration improving accuracy and speed. |

| Predictive Decisioning | Real-time risk and portfolio insights that guide smarter lending and operations. |

| Conversational AI | Always-on engagement through humanized virtual assistants. |

| Responsible Governance | Ethical, explainable frameworks aligning innovation with accountability. |

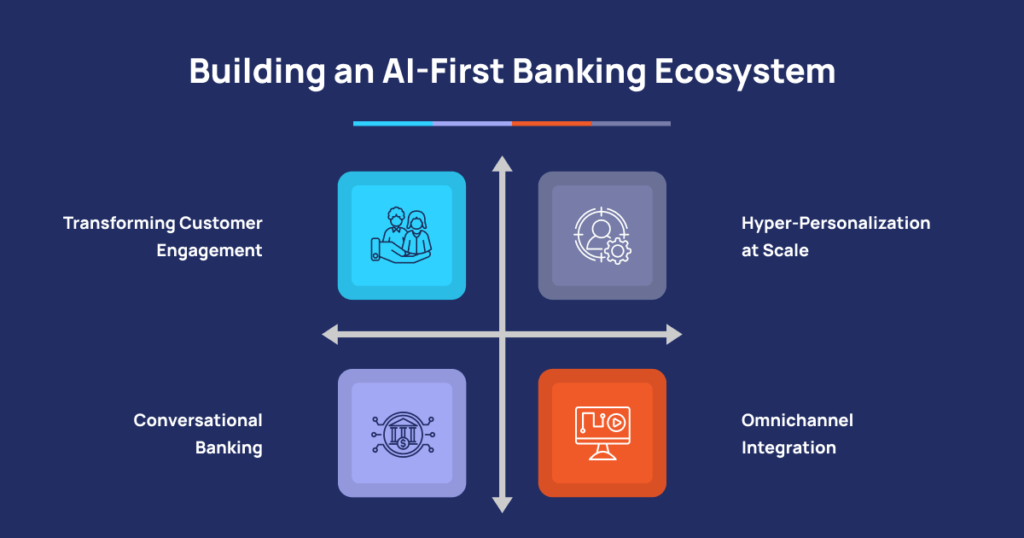

Building an AI-First Banking Ecosystem

Transforming Customer Engagement

The heart of banking has always been relationships, but the nature of those relationships is evolving. Customers still want trust and personalized service, but they also demand speed, convenience, and digital-first experiences.

Conversational Banking

First-generation chatbots frustrated more customers than they helped, offering rigid menu-based interactions that couldn’t handle anything beyond basic FAQs. Modern conversational banking chatbots powered by AI-driven customer service are fundamentally different. Powered by large language models, virtual banking assistants can understand context, handle complex multi-turn conversations, and provide genuinely helpful guidance.

These AI-driven assistants can:

- Answer nuanced questions about financial products, explaining differences between mortgage types or investment strategies in plain language.

- Help customers complete complex transactions, walking them through loan applications or investment decisions.

- Provide proactive financial guidance, alerting customers to unusual spending patterns or better savings opportunities.

- Operate 24/7 in multiple languages, ensuring no customer inquiry goes unanswered.

The key difference is contextual understanding. When a customer asks, “Can I afford to buy a house right now?” a modern AI assistant can analyze their financial situation, consider current market conditions, and provide personalized guidance—something that would typically require scheduling time with a human advisor.

Hyper-Personalization at Scale

Every customer wants to feel like their bank understands their unique situation, but providing truly personalized banking experiences to millions of customers has been logistically impossible—until now. AI enables hyper-personalization by analyzing individual customer data, behavior patterns, life events, and financial goals to deliver customized experiences through AI personalized services.

This might mean:

- Customized product recommendations that actually match a customer's life stage and financial capacity

- Personalized financial wellness content delivered at exactly the right moment

- Customized mobile banking interfaces that prioritize the features each customer uses most

- Proactive alerts about opportunities that match specific financial goals

The beauty of AI-driven personalization is that it improves over time. The more a customer interacts with AI-powered systems, the better those systems understand their preferences and needs, creating a virtuous cycle of improving service quality.

Omnichannel Integration

Customers don’t think in channels, but they think in experiences. They might start a loan application on mobile, continue it on desktop, call with questions, and finish at a branch. Digital banking AI enables true omnichannel banking by maintaining context across every touchpoint.

When a customer calls after starting a mobile application, the AI-powered agent instantly knows where they left off, what questions they’ve asked, and what hesitations they may have. This seamless experience, powered by integrated AI systems, eliminates the frustration of repeatedly explaining the same situation to different representatives or systems.

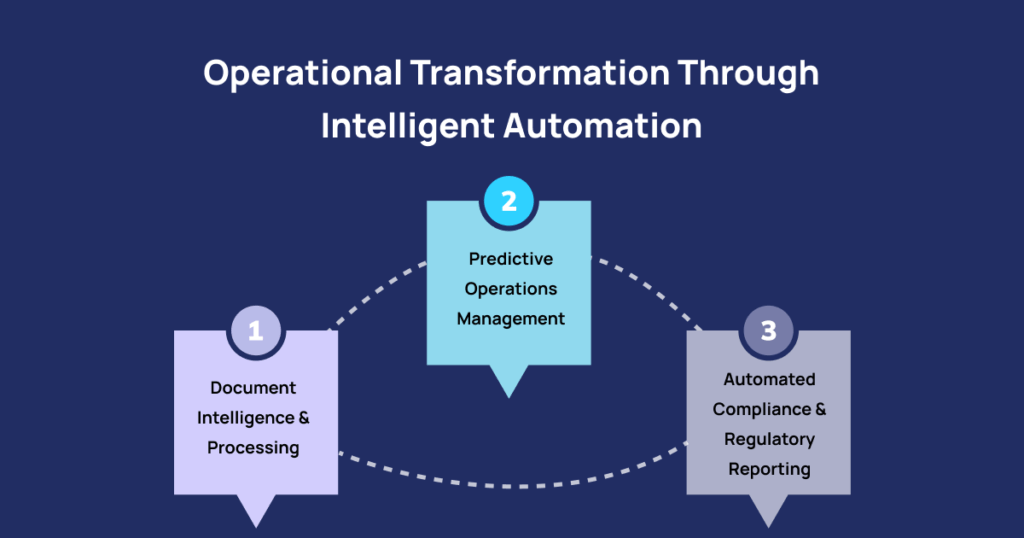

Operational Transformation Through Intelligent Automation

While customer-facing AI gets most of the attention, operational transformation through automation in finance might deliver even greater value. Banks spend enormous resources on repetitive processes, manual data entry, document processing, and operational risk management—tasks where AI excels.

Document Intelligence and Processing

Traditional document processing requires armies of staff to review loan applications, verify identities, process claims, and ensure compliance. AI-powered document intelligence can extract, understand, and verify information from any document type—whether structured forms or unstructured letters—with accuracy rates that often exceed human performance.

This transformation dramatically accelerates processes that once took days or weeks. Mortgage applications that require extensive manual review can be processed in hours. Know Your Customer (KYC) verification, which demanded multiple staff reviews, can happen instantly. The result isn’t just speed—it’s accuracy, consistency, and freed human capacity to focus on complex cases that genuinely require human judgment.

Predictive Operations Management

AI doesn’t just automate current processes—it predicts what’s coming and adjusts accordingly. Predictive analytics can forecast call volumes, transaction patterns, and service demands, enabling dynamic resource allocation.

If AI predicts a surge in customer inquiries based on market events, systems can proactively prepare by scaling virtual assistant capacity, alerting human staff, and pushing proactive communications to address likely concerns before customers even call. This shift from reactive to predictive operations management represents a fundamental capability upgrade.

Automated Compliance and Regulatory Reporting

Compliance represents one of banking’s heaviest operational burdens. Regulations constantly evolve, reporting requirements grow more complex, and the penalties for non-compliance can be catastrophic. AI transforms compliance from a cost center into a strategic advantage through AI-automated compliance.

Ensuring Security and Compliance in AI Integration Services in Banking has become critical as institutions deploy these technologies. AI compliance systems can monitor transactions in real-time, flag potential regulatory issues, generate required reports automatically, and adapt to regulatory changes faster than manual processes ever could.

The strategic value extends beyond cost savings. Banks with superior AI-driven compliance capabilities can enter new markets faster, launch products more quickly, and operate with confidence that they’re maintaining regulatory adherence even as rules change.

AI-Powered Risk and Fraud Management

Risk management AI, and fraud detection represent areas where AI’s impact is already dramatic and will only accelerate. The nature of financial crime is evolving rapidly, with criminals leveraging AI themselves to create more sophisticated attacks. Banks need AI not just for efficiency, but for survival.

Real-Time Fraud Detection

Traditional fraud detection systems rely on rules-based logic: if a transaction matches certain patterns (wrong location, unusual amount, suspicious merchant), flag it for review. These systems generate enormous numbers of false positives while still missing sophisticated attacks that don’t fit predefined patterns.

Fraud detection AI operates fundamentally differently. Machine learning models analyze thousands of variables simultaneously, learning normal behavior patterns for each customer and identifying anomalies that might indicate fraud. What Are the Key Components of a Successful AI-Powered Fraud Detection Banking Strategy? explores this transformation in depth.

Modern AI fraud detection systems can:

- Analyze transaction context in real-time, considering device fingerprints, location data, transaction timing, and behavioral biometrics.

- Identify subtle patterns across millions of transactions that would be impossible for humans to spot.

- Adapt continuously as fraud tactics evolve, learning from new attack vectors without waiting for rule updates.

- Balance security with customer experience, reducing false positives that frustrate legitimate customers.

The results are striking. Banks implementing advanced AI fraud detection report 50-70% reductions in fraud losses while simultaneously cutting false positive rates, meaning fewer legitimate transactions get blocked and fewer customers receive unnecessary fraud alerts.

Advanced Risk Assessment

Traditional credit scoring and risk assessment AI rely on relatively limited data points: credit history, income, and employment. AI enables far more sophisticated risk modeling by incorporating thousands of variables and identifying complex patterns that predict creditworthiness or default risk.

This expanded capability serves multiple strategic purposes:

- Expanding Financial Inclusion: AI can identify creditworthy customers who lack traditional credit histories by analyzing alternative data sources—utility payments, rental history, employment patterns, education—enabling banks to safely serve previously underbanked populations.

- Dynamic Risk Pricing: Rather than static risk categories, AI enables continuous risk reassessment, allowing banks to adjust terms dynamically as customer risk profiles evolve. This benefits both institutions and customers, rewarding improved financial behavior with better rates.

- Portfolio-Level Risk Management: Beyond individual assessments, AI can model systemic risks across entire loan portfolios, identifying concentration risks, correlation patterns, and potential vulnerabilities before they materialize into losses.

Compliance and Regulatory Risk

Financial compliance isn’t just about following rules—it’s about demonstrating to regulators that you have robust systems ensuring consistent adherence even as regulations evolve. 5 Essential Guardrails for Responsible LLM Deployment and AI Compliance in Banking provides crucial guidance for institutions navigating this landscape.

AI transforms regulatory compliance in several ways:

- Continuous Monitoring: Rather than periodic compliance audits, AI enables continuous monitoring of all transactions, communications, and activities against regulatory requirements, identifying potential issues in real-time before they become reportable incidents.

- Regulatory Change Management: When regulations change, updating manual compliance processes can take months. AI systems can be updated and deployed across entire operations in days or weeks, ensuring rapid adaptation to new requirements.

- Audit Trail and Explainability: Modern AI compliance systems maintain comprehensive audit trails showing exactly why decisions were made, how data was used, and what factors influenced outcomes—critical capabilities for regulatory examinations.

The strategic advantage extends beyond risk mitigation. Banks with robust AI-driven compliance capabilities can innovate faster, knowing they have systems that will maintain compliance even as they launch new products or enter new markets.

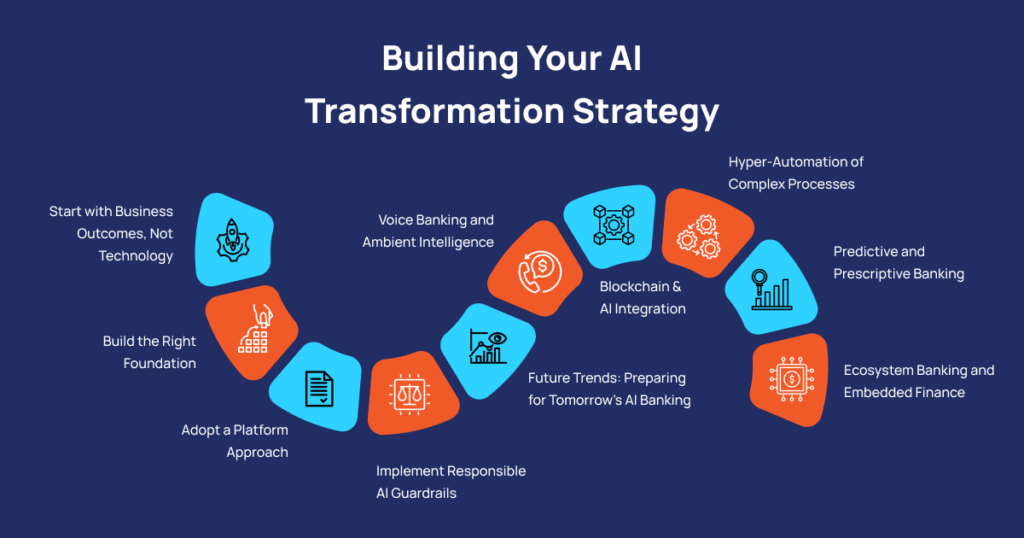

Building Your AI Transformation Strategy

Understanding AI’s potential is one thing. Actually implementing a successful AI-driven banking strategy is another. Many banks have launched AI initiatives that delivered disappointing results—pilot projects that never scaled, technology investments that didn’t drive business value, or implementations that created more problems than they solved.

Building a Winning AI Transformation Strategy for Banking in 2026 provides a comprehensive roadmap, but several core principles deserve emphasis here.

Start with Business Outcomes, Not Technology

The biggest mistake in AI banking transformation is starting with technology and looking for problems to solve. Successful transformations start with clear business outcomes: reducing operational costs, improving customer satisfaction scores, and cutting fraud losses.

These outcome-focused goals ensure that technology investments drive measurable business value. They also provide clear metrics for assessing success and making course corrections when initiatives aren’t delivering expected results.

Build the Right Foundation

AI transformation requires strong foundations across data, technology infrastructure, talent, and culture. Many transformation efforts stall because institutions try to deploy advanced AI capabilities on inadequate foundations.

- Data Foundation: AI is only as good as the data it learns from. This means investing in data quality, data governance, and data infrastructure that can support AI workloads. Banks need unified customer data platforms that break down silos between departments and channels.

- Technology Infrastructure: Modern AI requires cloud-scale computing, flexible architectures that can adapt as capabilities evolve, and integration frameworks that connect AI systems with existing banking platforms, including AI in payments processing. The rise of AI in digital banking demonstrates how payment systems are being transformed through intelligent automation.

- Talent and Skills: Successful AI transformation requires new skills—data scientists, machine learning engineers, and AI product managers. But it also requires upskilling existing staff to work effectively alongside AI systems and understand their capabilities and limitations.

- Cultural Transformation: Perhaps most challenging, AI transformation requires cultural change. Staff need to shift from "this is how we've always done it" to continuous experimentation and learning. Leadership needs to embrace data-driven decision-making and be willing to challenge traditional assumptions.

Adopt a Platform Approach

Rather than building isolated AI point solutions, leading banks are creating AI platforms that enable rapid development and deployment of new capabilities. This platform approach includes:

- Shared AI infrastructure and tools that teams across the organization can leverage.

- Common data pipelines that feed AI models across different use cases.

- Standardized frameworks for model development, testing, and deployment.

- Centralized governance ensures consistent approaches to security, compliance, and ethics.

The platform approach dramatically accelerates innovation. Once the foundation is built, new capabilities can be developed and deployed in weeks rather than months or years.

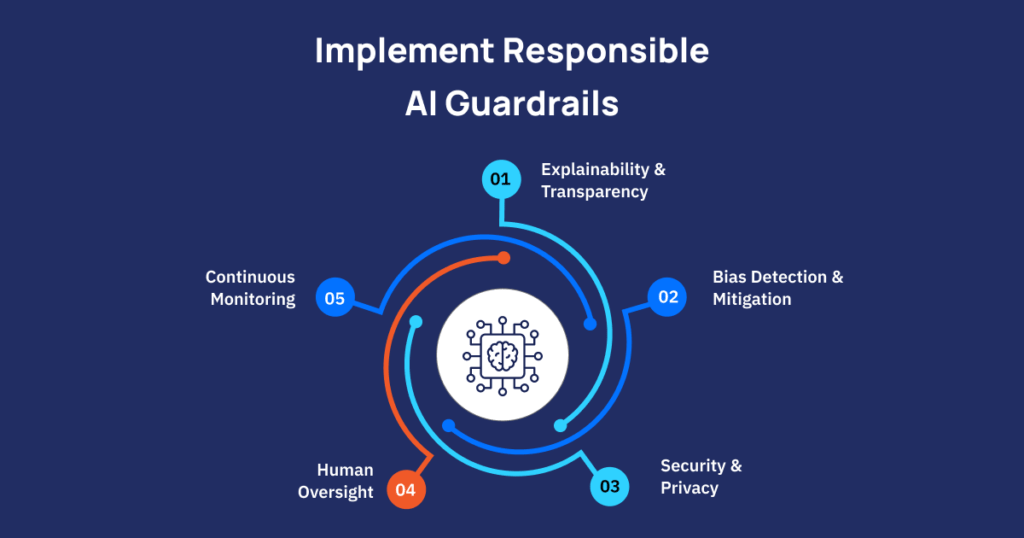

Implement Responsible AI Guardrails

As banks deploy AI more extensively, ensuring these systems operate responsibly becomes critical. This isn’t just about regulatory compliance—it’s about maintaining customer trust and avoiding catastrophic failures.

Generative AI for Banking: Transforming Risk, Compliance, and Customer Experience explores how institutions are navigating this landscape. Key guardrails include:

- Explainability and Transparency: Customers and regulators need to understand why AI systems make certain decisions, particularly for consequential outcomes like loan denials or fraud flags.

- Bias Detection and Mitigation: AI systems can perpetuate or amplify biases in training data, leading to unfair outcomes. Robust testing and monitoring processes must identify and address potential biases.

- Security and Privacy: AI systems process enormous amounts of sensitive customer data. Comprehensive security frameworks must protect this data while ensuring AI systems themselves can't be manipulated or attacked.

- Human Oversight: Not every decision should be fully automated. Clear frameworks must define when human review is required and how humans and AI systems work together on complex decisions.

- Continuous Monitoring: AI systems must be continuously monitored for performance degradation, unexpected behaviors, or emerging issues, with clear processes for intervention when problems arise.

Future Trends: Preparing for Tomorrow's AI Banking

The AI banking transformation underway today is just the beginning. Several emerging trends will reshape banking even more dramatically over the next 3-5 years.

Voice Banking and Ambient Intelligence

As voice interfaces become more sophisticated and prevalent, voice-first conversational banking will emerge as a major channel. Customers will manage finances through voice assistants in cars, homes, and mobile devices, asking questions and completing transactions through natural conversation.

Beyond simple voice commands, ambient intelligence will enable proactive banking assistance integrated into daily life. Your banking AI might notice you’ve arrived at a car dealership and proactively offer pre-approved financing options. Or it might hear you discussing a major purchase and provide spending guidance based on your budget and goals.

Blockchain and AI Integration

The integration of blockchain technology with AI creates powerful new capabilities. Smart contracts can execute automatically based on AI analysis. AI can monitor blockchain transactions for fraud or compliance issues in real-time. Decentralized finance (DeFi) protocols powered by AI could offer more efficient alternatives to traditional banking services.

For traditional banks, this integration offers opportunities to create new products, reduce costs, and improve transparency. The institutions that figure out how to blend centralized trust with decentralized efficiency will have significant advantages.

Hyper-Automation of Complex Processes

Current AI automation focuses mainly on repetitive, rules-based processes. The next wave will tackle increasingly complex processes requiring judgment, creativity, and multi-step reasoning.

We’ll see AI systems that can:

Predictive and Prescriptive Banking

Current AI applications are largely reactive—responding to customer inquiries, flagging suspicious transactions, and processing applications. Future AI will be increasingly predictive and prescriptive, anticipating needs and proactively recommending actions.

Your bank might predict a cash flow gap three months in advance and proactively offer a bridge loan. Or it might notice your investment portfolio drifting from target allocations and automatically rebalance according to your preferences. Or it might predict you’re likely to experience a significant life change—marriage, home purchase, career shift—and proactively reach out with relevant guidance and products.

This shift from reactive to predictive creates stickier customer relationships and positions banks as true financial partners rather than just service providers.

Ecosystem Banking and Embedded Finance

Banking is increasingly embedded in non-banking contexts—purchasing a car, shopping online, running a business. AI enables sophisticated embedded finance capabilities that provide banking services seamlessly within other experiences.

For traditional banks, this means developing AI-powered APIs and platforms that partner businesses can easily integrate, creating new distribution channels and revenue streams. It also means competition from non-banks offering banking services—think Amazon, Apple, or Shopify providing sophisticated financial products powered by AI.

The Competitive Imperative

The institutions asking “How soon will AI reduce the need for human roles at different levels within banks?” are asking the wrong question. AI won’t reduce the need for talented people—it will change what those people do and dramatically raise the bar for competitive performance.

Banks that successfully transform will operate with radically different cost structures, customer satisfaction levels, and innovation speeds than those that don’t. The competitive gap will widen rapidly over the next few years.

Consider what “specific use cases and benefits are emerging from AI agents in banking operations”—the answer is: almost everything. From customer service to fraud detection, risk management to compliance, product development to marketing, AI is transforming every aspect of banking operations. The question isn’t where AI will have an impact, but whether your institution will lead or follow this transformation.

Taking the First Steps

For banking executives reading this and wondering where to start, here’s a practical roadmap:

Immediate Actions (Next 30-90 Days):

- Assess your current AI maturity across customer engagement, operations, and risk management.

- Identify 2-3 high-value, relatively contained use cases where AI could deliver measurable business impact.

- Audit your data infrastructure and identify critical gaps that would limit AI effectiveness.

- Build or acquire core AI talent—even a small team can catalyze broader transformation.

- Establish governance frameworks for responsible AI deployment from the beginning.

Medium-Term Priorities (3-12 Months):

- Launch pilot projects in your identified use cases, focusing on rapid learning over perfection.

- Begin building platform capabilities that will enable scaling successful pilots.

- Invest in change management and training to prepare your organization for new ways of working.

- Develop partnerships with technology providers who can accelerate your transformation.

- Create clear metrics and dashboards for tracking AI business impact.

Long-Term Strategic Goals (1-3 Years):

- Scale successful pilots across the organization, transitioning from experimentation to operational deployment.

- Build comprehensive AI platforms that enable rapid innovation across all business units.

- Transform organizational culture to embrace continuous learning, experimentation, and data-driven decision-making.

- Position your institution as an AI-driven industry leader, attracting top talent and customer preference.

- Continuously evolve capabilities to stay ahead of competitive threats and leverage emerging technologies.

Strategic Takeaways

These strategic takeaways summarise the core focus areas of AI-led transformation, outlining how each pillar contributes to sustainable growth, compliance, and customer-centric innovation.

| Transformation Pillar | Strategic Focus | Key Business Impact |

|---|---|---|

| AI-First Ecosystem | Integrate intelligence across all banking | End-to-end agility and innovation. |

| Fraud & Risk AI | Real-time predictive detection and assessment. | Fraud loss reduction and resilience. |

| Compliance & LLM Governance | Ethical, explainable AI frameworks. | Regulatory trust and confidence. |

| Personalization | Deploy hyper-personalized experiences. | Customer loyalty and growth. |

| Conversational AI | Enable humanized, always-on engagement. | Cost efficiency and satisfaction. |

| Operational Intelligence | Unify automation and analytics. | Faster, smarter decisions. |

Conclusion

The shift from traditional to AI-first banking isn’t just technological—it’s a reinvention of financial services. The winners will be those who move boldly, learn fast, and focus on real customer value.

AI delivers powerful gains: lower costs, faster operations, fewer errors, stronger fraud detection, smarter credit decisions, and more personalized, seamless experiences. Yet, the real advantage lies in strategic agility—the ability to innovate, adapt, and seize opportunities faster than competitors.

Banks that master AI banking transformation will not only thrive today but evolve continuously, powered by agile platforms, skilled talent, and customer trust.

The choice to embrace AI isn’t optional—market forces have already made it inevitable. What matters now is how fast and how effectively you act. The future of banking is being built today—and the time for bold action is now.

Frequently Asked Questions (FAQs)

1. What is AI banking transformation and why is it critical for financial institutions?

AI banking transformation is the strategic overhaul of banking operations, customer engagement, and risk management through artificial intelligence. It goes beyond automation to reimagine how banks operate using digital banking AI, conversational banking, and predictive analytics. This transformation is critical because traditional models can’t meet customer expectations for 24/7 service and instant approvals. Banks implementing an AI-driven banking strategy gain competitive advantages through reduced costs, enhanced fraud detection AI, improved AI compliance, and superior customer satisfaction while adapting faster than competitors on legacy systems

2. How does fraud detection AI improve security compared to traditional methods?

Fraud detection AI surpasses traditional rule-based systems by analyzing thousands of variables simultaneously in real-time. While conventional methods generate high false positives, risk management AI learns each customer’s unique behavioral patterns through device fingerprints, location data, and transaction timing. Banks implementing fraud detection AI report 50-70% reductions in fraud losses while cutting false positive rates by half. The system continuously adapts to new attack vectors without manual updates, essential for combating sophisticated financial crimes.

3. What role do virtual banking assistants play in conversational banking?

Virtual banking assistants powered by conversational banking chatbots use large language models for AI-driven customer service that understands context and handles complex conversations 24/7. Unlike rigid menu systems, modern conversational banking assistants answer nuanced financial questions, explain mortgage types, guide loan applications, and deliver personalized banking experiences. They analyze customer situations in real-time to offer advice that traditionally required human advisors, creating seamless omnichannel experiences while reducing operational costs.

4. How does AI-automated compliance help banks manage regulatory requirements?

AI-automated compliance transforms regulatory adherence into a strategic advantage through continuous monitoring of transactions and activities. AI compliance systems identify potential issues in real-time before they become reportable incidents. When regulations change, AI-automated compliance updates deploy across operations in days rather than months. These systems maintain comprehensive audit trails for regulatory examinations, while risk management AI capabilities enable faster innovation, market entry, and product launches with confidence in regulatory adherence

5. What are the key components needed for successful AI in payments and personalized banking experiences?

Successful AI in payments and personalized banking experiences requires four elements: unified data infrastructure enabling AI personalized services across touchpoints; digital banking AI platforms analyzing customer behavior and financial goals in real-time; automation in finance systems integrating across mobile, web, voice, and branch channels; and responsible AI guardrails ensuring explainability and security. Together, these enable hyper-personalization at scale—delivering customized recommendations, proactive alerts, and tailored interfaces that improve continuously.

Ready to begin your AI banking transformation journey? The path forward requires commitment, investment, and expertise—but the rewards for institutions that get it right are transformative. Start with clear business outcomes, build strong foundations, implement responsible guardrails, and move with urgency. The AI-first bank of tomorrow is being built today by institutions willing to reimagine what banking can be.