Table of Contents

Summarize and analyze this article with

Introduction

Every decision in business carries risk but the difference between surviving and thriving lies in how risk is managed. Enterprises that treat risk as a strategic asset gain speed, clarity, and resilience. Insurance risk management consulting provides the tools, frameworks, and expertise to transform scattered risk signals into actionable intelligence, ensuring that organizations don’t just respond to threats but stay ahead of them.

In this blog, we explain how modern insurance risk management consulting works, where businesses struggle, and how AI-led and enterprise-wide approaches are changing outcomes.

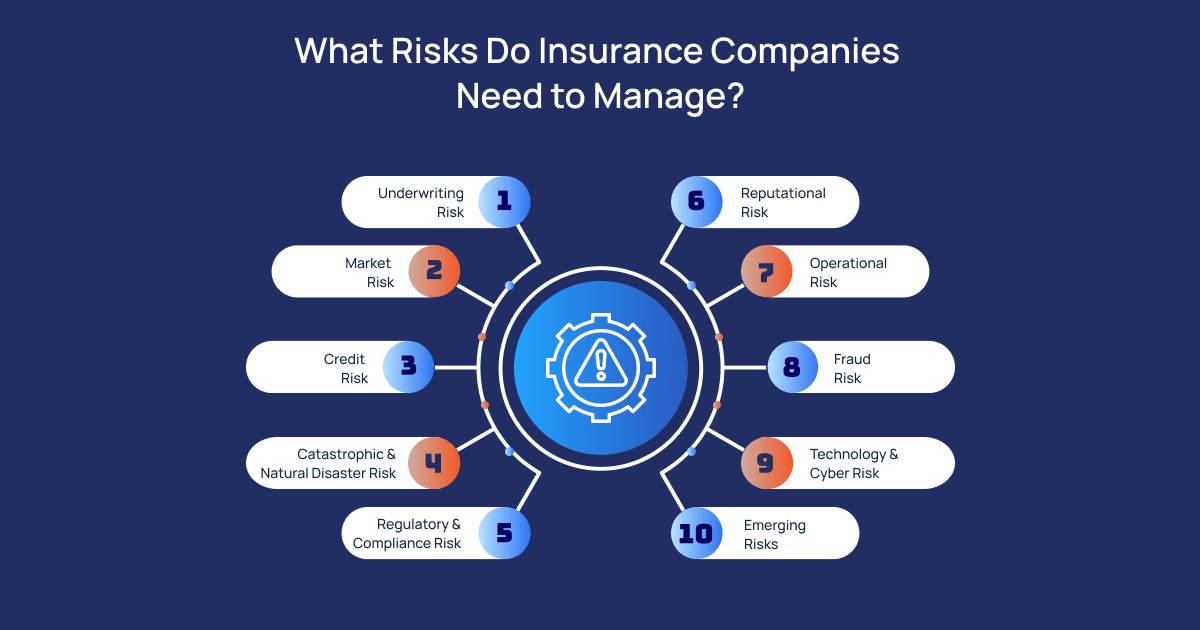

What Risks Do Insurance Companies Need to Manage?

- Underwriting Risk: This arises when policies are mispriced, risks are assessed incorrectly, or events unfold in ways that were not anticipated, leading to higher-than-expected claims.

- Market Risk: Insurers invest premiums to generate returns, which exposes them to fluctuations in interest rates, currency movements, and equity markets that can impact portfolio value.

- Credit Risk: There is always the possibility that policyholders delay or miss premium payments, or that reinsurers fail to honour their obligations. Strong controls are essential to limit this exposure.

- Catastrophic and Natural Disaster Risk: Extreme weather events, large-scale accidents, or natural catastrophes can lead to a spike in claims over a short period, directly affecting profitability and capital adequacy.

- Regulatory and Compliance Risk: Insurance firms operate in a heavily regulated environment. Regulatory changes or compliance failures can result in fines, operational disruption, and reputational damage.

- Reputational Risk: Customer complaints, negative media coverage, or ethical lapses can quickly erode trust and lead to reduced customer retention and new business.

- Operational Risk: Breakdowns in internal processes, system failures, or human error can cause financial losses and interrupt day-to-day operations.

-

Fraud Risk: Fraudulent claims remain a persistent challenge for insurers, driving up costs and placing pressure on margins if not detected early.

- Technology and Cyber Risk: As insurers rely more on digital systems, exposure to cyberattacks, data breaches, and IT outages continues to grow.

- Emerging Risks: Shifts in technology, economic conditions, climate patterns, and customer behaviour introduce new risks that may not yet be fully understood or priced into existing models.

What Insurance Risk Management Consulting Really Delivers

- Insurance programme reviews and policy audits

- Risk financing and transfer strategies

- Cyber risk management insurance advisory

- Regulatory and compliance support

How AI Is Reshaping Insurance Risk Management Consulting

- Predicting loss frequency and severity

- Identifying emerging cyber threats early

- Flagging policy gaps before incidents occur

- Reducing manual reporting workloads

Managing Cyber Risk Through Insurance Consulting

- Mapping technical controls to insurance requirements

- Reviewing exclusions and sub-limits

- Aligning coverage with real-world attack scenarios

This approach reduces claim disputes and improves insurer confidence. For many organisations, it also lowers premiums over time.

Solving Compliance and Regulatory Complexity

Regulatory pressure continues to rise. ESG reporting, data protection laws, and sector-specific mandates demand tighter controls.

Insurance risk management consulting helps organisations keep pace without adding complexity. Consultants standardise risk processes, align documentation, and ensure insurance programmes reflect regulatory obligations.

McKinsey estimates that companies using integrated risk and compliance platforms reduce compliance costs by up to 30 percent. That efficiency matters when resources are tight.

External references, such as guidance from the World Economic Forum or regulatory updates from OECD risk policy reports, often support this work and keep frameworks current.

Addressing the Risk Talent Shortage

Many organisations struggle to hire experienced risk professionals. Consulting fills that gap while building internal capability.

Leading firms combine advisory support with training programs. They help teams understand risk models, insurance structures, and AI tools. Over time, businesses become less dependent on external help.

Deloitte’s 2025 risk outlook highlights talent development as a top priority for sustainable risk programs. Strategic consulting supports this shift.

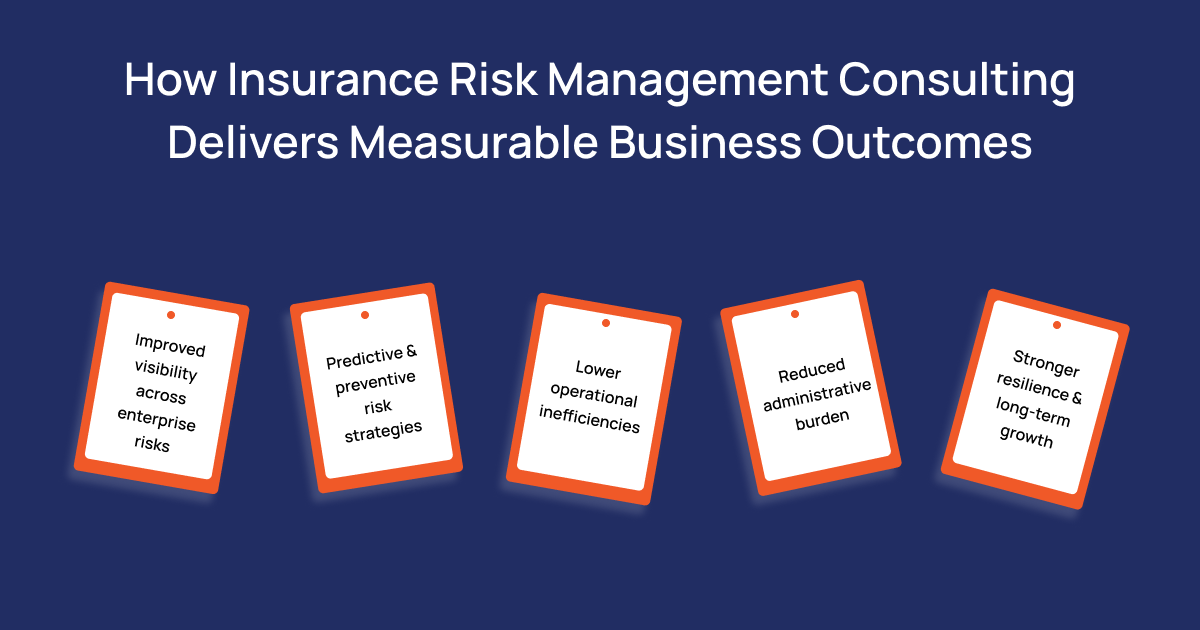

How Insurance Risk Management Consulting Delivers Measurable Business Outcomes

When done right, insurance risk management consulting delivers clear results.

Businesses gain a single view of risk exposure. Leaders move from reacting to incidents to preventing them. Compliance becomes predictable rather than stressful.

Common outcomes include:

- Improved visibility across enterprise risks

- Predictive and preventive risk strategies

- Lower operational inefficiencies

- Reduced administrative burden

- Stronger resilience and long-term growth

PwC reports that organisations with mature risk frameworks are 2.5 times more likely to outperform peers during market disruptions.

Why Insurance Risk Management Consulting Is a Strategic Partner

Insurance risk management consulting has evolved. It now plays a central role in business strategy, not just protection.

By combining AI in insurance risk, enterprise frameworks, and expert advisory, consultants help organisations navigate uncertainty with confidence. In 2025 and beyond, this partnership becomes essential for sustainable growth.

For businesses aiming to strengthen risk posture, consulting is no longer optional. It is a strategic investment in stability, compliance, and resilience.

Conclusion

Insurance risk management has evolved from a protective function into a strategic business capability. As risks become more complex and interconnected, organisations need more than reactive controls. They need visibility, foresight, and the ability to act early. Insurance risk management consulting brings structure, intelligence, and strategic alignment to risk decisions, helping businesses protect stability, meet regulatory demands, and support long-term growth. In a rapidly changing risk landscape, proactive risk management is no longer optional. It is essential.

At PiTech, we help organisations turn risk intelligence into action. Our insurance risk management solutions combine AI-led analytics, enterprise risk frameworks, and deep industry expertise to help businesses anticipate threats, strengthen controls, and protect growth with confidence.

If your organization is ready to move beyond reactive risk management and build a future-ready risk strategy, PiTech is your strategic partner.

Key Takeaways

- Risk management must support business decisions, not just compliance.

- Insurance risk consulting focuses on understanding exposure first.

- AI helps predict risks instead of reacting to incidents.

- Cyber risk needs better alignment between security and insurance.

- Integrated risk and compliance reduces operational effort and cost.

- Consulting supports teams where risk talent is limited.

- Strong risk frameworks improve resilience and long-term performance.

Frequently Asked Questions (FAQs)

How can insurance risk management consulting help prevent business losses?

What are the newest tools and technologies in insurance risk consulting?

How do insurance consultants assess and mitigate cyber risks for businesses?

What are common challenges faced in insurance risk management consulting?

How does AI improve insurance risk management consulting outcomes?

AI improves outcomes by detecting risk patterns earlier, supporting faster and more accurate decisions, automating compliance monitoring, and enabling predictive rather than reactive risk strategies.