Table of Contents

Summarize and analyze this article with

Introduction

Tight budgets, manual processes, rising compliance expectations, and increasing customer demands for fast, personalized service put community banks under constant pressure. While larger institutions have been early adopters of advanced technology, many are now discovering practical, cost-effective ways to implement AI for community banks and improve machine learning banking efficiency to enhance everyday operations.

When implemented thoughtfully, AI banking solutions can support smaller institutions with meaningful efficiency gains, stronger compliance, and better service without the need for massive transformation projects.

This blog explores how community banks can harness AI/ML across automation, customer service, risk management, and compliance by offering practical recommendations and highlighting the tangible business outcomes.

Why AI/ML Matters for Community Banks

1. Limited resources and lean operational staff

2. Heavy regulatory and reporting expectations

Compliance obligations, including BSA/AML monitoring, customer due diligence, suspicious activity reporting, and audit preparation, consume thousands of staff hours each year. AI regulatory compliance tools can help reduce this burden on community banks.

3. Heightened fraud risks and customer expectations

Digital banking has raised baseline expectations for speed and personalization while increasing exposure to fraud and identity theft attempts. Fraud detection AI in community banks helps address these challenges effectively.

Implementing AI for community banks and leveraging machine learning allow these institutions to address operational challenges without increasing headcount or overburdening staff. By automating routine tasks and enhancing decision-making accuracy, banks can redirect employees to higher-value activities.

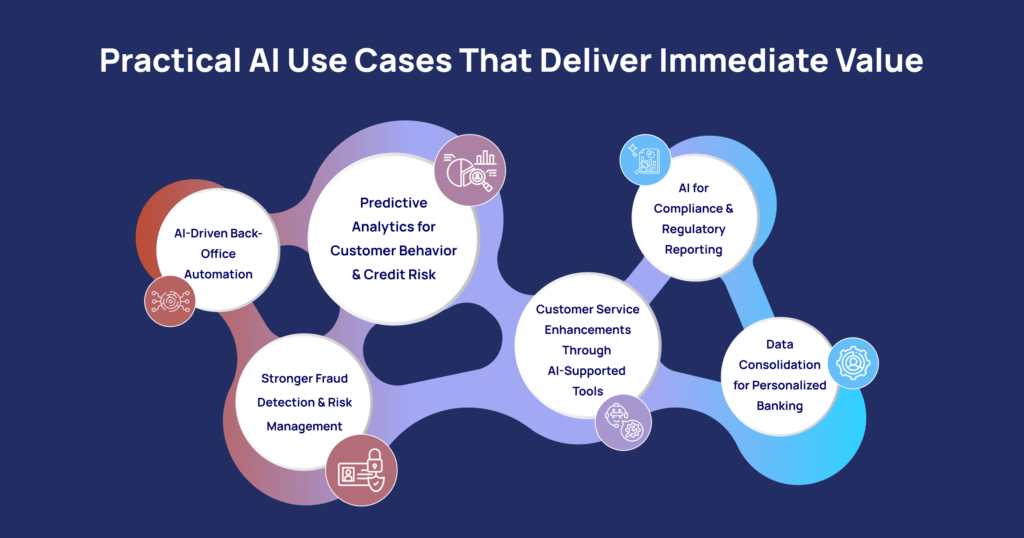

Practical AI Use Cases That Deliver Immediate Value

1. AI-Driven Back-Office Automation

Back-office processes such as reconciliations, data entry, document classification, and exception handling are often repetitive and slow. With AI automation tools, banks can:

- Extract and categorize information from forms and PDFs.

- Match transactions automatically.

- Identify discrepancies without manual spreadsheet work.

- Process loan documents and supporting materials faster.

Many institutions see 25–30% reductions in operational costs when routine tasks are automated, especially in loan operations and deposit services.

2. Predictive Analytics for Customer Behavior and Credit Risk

Predictive analytics in banking helps understand patterns that humans might miss. Instead of relying solely on static reports, teams can monitor trends in real time:

- Early indicators of credit risk.

- Customers are likely to churn.

- Opportunities for cross-selling or product recommendations.

- Behavioral patterns that signal fraud.

3. Customer Service Enhancements Through AI-Supported Tools

Community banks rarely have the staffing levels to provide 24/7 customer support. Virtual assistants and chat tools make this possible without adding full-time employees.

These tools improve AI customer experience in banking:

- Answer common questions instantly.

- Assist with account inquiries.

- Route issues to the right team.

- Reduce hold times during busy hours.

4. Stronger Fraud Detection and Risk Management

Smaller banks are frequently targeted by fraudsters because their manual review processes are easier to exploit. Fraud detection AI in community banks significantly strengthen detection by analyzing thousands of data points at once, such as:

- Unusual transaction activity.

- Velocity patterns.

- Device or location inconsistencies.

- Sudden changes in behavior.

5. AI for Compliance and Regulatory Reporting

- Automating parts of BSA/AML monitoring

- Categorizing alerts

- Scanning transactions for rule-based and behavioral indicators

- Preparing and organizing data for SAR filings

- Keeping documentation structured for audits

Some tools also provide explainable AI outputs, which show how decisions or flags were generated. This transparency is essential for regulators and reduces the “black box” concerns common with advanced models.

6. Data Consolidation for Personalized Banking

Most community banks operate with multiple disconnected systems, including core banking, loan origination, CRM, compliance, ACH, and more. AI helps unify these data sources, creating a more complete customer picture. The benefits include:

- More personalized service.

- Better product recommendations.

- Streamlined onboarding.

- Faster review processes.

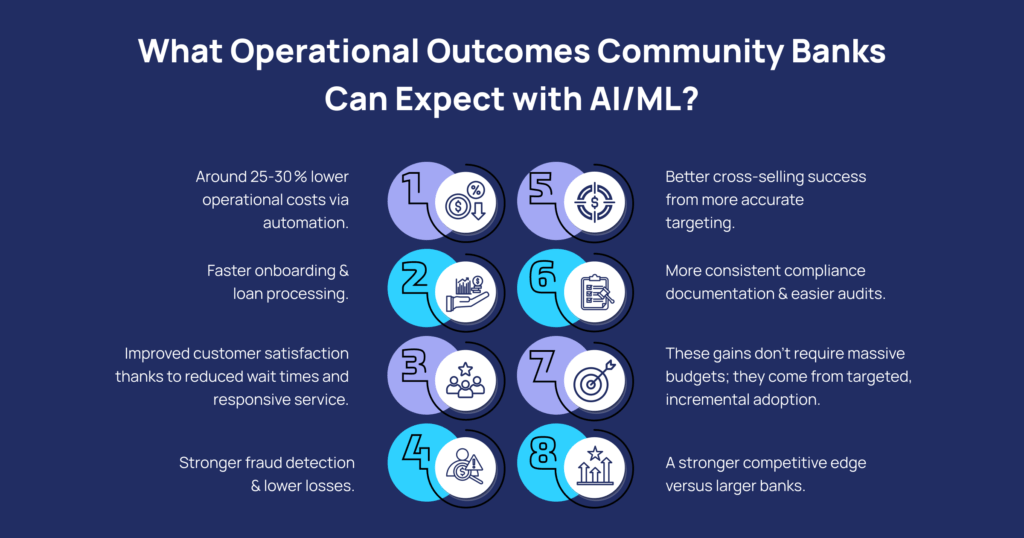

What Operational Outcomes Community Banks Can Expect with AI/ML?

- Around 25‑30 % lower operational costs via automation.

- Faster onboarding and loan processing.

- Improved customer satisfaction thanks to reduced wait times and responsive service.

- Better cross‑selling success from more accurate targeting.

- Stronger fraud detection and lower losses.

- More consistent compliance documentation and easier audits.

- A stronger competitive edge versus larger banks.

- These gains don’t require massive budgets; they come from targeted, incremental adoption.

Real‑World Context: What the Data Says

-

A recent survey found that 33 % of bankers at community banks said AI is 2025’s top technology trend.

-

According to analytics from a global bank review, AI could bring cost reductions of 15–20% in aggregate cost base across banking operations.

-

A 2025 survey of US community banks shows that 47% plan to adopt AI for customer interactions , which is a 16 percentage-point increase over prior years.

-

Research shows many banks will fully integrate AI strategies by 2025, with estimates such as 75% of banks with over USD 100 billion in assets doing so.

These numbers highlight that community banks are catching up and using AI not just for hype, but for concrete shifts in operational practice.

Conclusion

AI for community banks and machine learning banking efficiency are no longer technologies reserved for large institutions with massive budgets. Community banks can now leverage practical, affordable AI banking solutions to automate routine tasks, strengthen compliance, and enhance customer service. By focusing on high-impact use cases such as AI automation, predictive analytics, fraud prevention, compliance, and customer support, banks can achieve meaningful operational efficiency gains while maintaining the personal relationships that set them apart.

If implemented effectively, AI becomes a quiet engine running in the background, helping teams work faster and smarter while keeping customers at the center of every decision.

Transform your community bank with PiTech AI banking solutions. Contact Us to implement AI automation, enhance customer experience, and drive banking efficiency.

Key Takeaways

-

Operational Efficiency – AI automates back-office tasks like data entry, reconciliations, and loan processing, cutting costs by 25–30%.

-

Predictive Insights – ML identifies credit risk , customer churn, cross-selling opportunities, and fraud patterns for better decision-making.

-

Enhanced Customer Service – Chatbots and virtual assistants handle routine inquiries, improving response times without adding staff.

-

Fraud Detection & Risk Management – AI analyzes transactions and behaviors to detect anomalies early and reduce losses.

-

Compliance Automation – AI supports BSA/AML monitoring, alert categorization, and audit preparation with explainable outputs.

-

Data Consolidation & Personalization – AI unifies multiple systems to provide a complete customer view for tailored services.

-

Improved Business Outcomes – Faster onboarding, higher customer satisfaction, better cross-selling, and stronger competitive edge.

-

Cost-Effective Adoption – Targeted AI/ML use delivers high-impact results without massive budgets or full-scale transformations.

Frequently Asked Questions (FAQs)

How are community banks currently using AI?

They use it mainly for automation, fraud detection, customer service, and compliance monitoring. Most implementations start small and expand over time.

What are common AI challenges in community banking?

Budget limitations, legacy system integration, and staff training are the most common hurdles. Modern AI tools are modular, cost-effective, and integrate with existing workflows.

How can AI improve customer service in smaller banks?

AI handles routine inquiries through chatbots and virtual assistants, freeing human staff to focus on complex or relationship-focused interactions. This improves response times and overall service quality.

What security measures are necessary for AI in banking?

Proper encryption, human oversight, explainable AI, and strong vendor controls are essential to ensure AI systems remain secure and compliant.

Are AI chatbots effective for community bank customer support?

Yes. Chatbots and virtual assistants manage common queries efficiently, reducing hold times and supporting staff rather than replacing them.

How does AI help with regulatory compliance for community banks?

AI simplifies monitoring, reduces manual errors, structures data for audits, and improves documentation for regulators, supporting more consistent and reliable compliance.