Table of Contents

Summarize and analyze this article with

Introduction

Regulatory compliance is becoming increasingly costly, slow, and risk-intensive when organisations rely on manual checks, spreadsheet-based controls, and reactive audits. These traditional approaches struggle to scale as regulatory requirements expand across data privacy, AI governance, financial crime, and cybersecurity.

AI automation offers a practical solution to these challenges, but many organizations struggle to assess its true cost and return. Most evaluations focus on software licensing while overlooking integration effort, data readiness, training, and ongoing governance. These hidden factors often determine whether compliance automation delivers real ROI or becomes an unexpected cost.

This blog explores how to calculate AI automation compliance costs accurately and uncover hidden expenses.

Why Compliance Costs Are Rising So Fast

Global regulatory complexity has increased sharply. According to Thomson Reuters, regulatory change volumes rose by over 45% in recent years, and the pace is expected to accelerate through 2026. Financial institutions now spend up to 10% of their operating budgets on compliance activities alone.

Manual compliance creates three major cost drivers:

-

Labour-intensive reviews and evidence collection

- High error rates that trigger rework and penalties

- Slow audit cycles that disrupt business operations

The Hidden Costs of Manual Compliance

Compliance goes beyond administrative tasks and represents a significant operational cost that impacts efficiency, scalability, and risk management. Manual reviews, spreadsheet-driven controls, and reactive audits introduce inefficiencies that become harder to manage as regulatory requirements expand. These approaches slow execution, increase rework, and limit a team’s ability to scale effectively.

Common hidden cost areas include:

-

Delays in customer onboarding and audit readiness

- High error rates that trigger rework and additional oversight

- Scalability challenges during regulatory updates

- Compliance team fatigue from repetitive, low-value tasks

- Increased risk of penalties due to missed or inconsistent controls

Taken together, these hidden costs reduce agility and raise risk exposure. This is why many organisations are re-evaluating manual compliance models in favour of AI-driven automation that improves efficiency, accuracy, and long-term scalability.

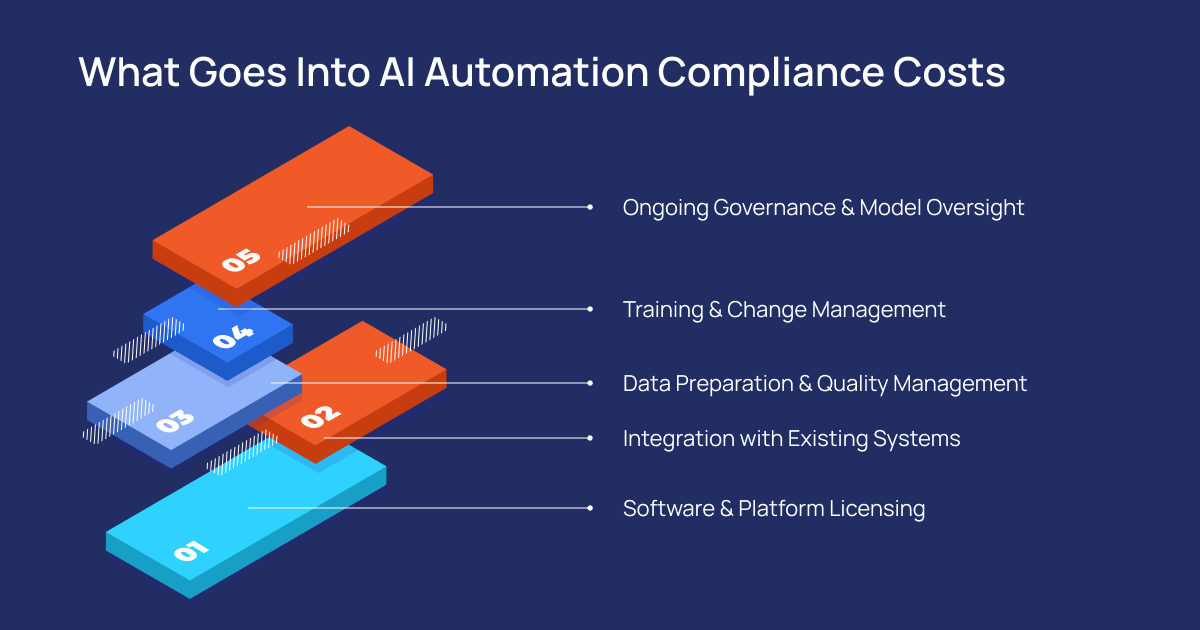

What Goes Into AI Automation Compliance Costs

1. Software and Platform Licensing

2. Integration With Existing Systems

AI does not work in isolation. It must connect with GRC platforms, ERP systems, identity tools, transaction systems, and document repositories.

Integration costs depend on data complexity, not just system count. Clean APIs reduce effort. Legacy systems increase it.

Typical mistake: Underestimating integration timelines and internal IT effort.

3. Data Preparation and Quality Management

AI compliance automation depends on accurate, structured data. Many organizations discover that compliance data is fragmented across departments.

Data preparation includes:

- Normalizing historical records

- Defining risk taxonomies

-

Creating audit-ready data pipelines

According to Gartner, poor data quality costs organizations an average of $15 million annually. AI amplifies this issue if data foundations are weak.

4. Training and Change Management

AI reduces workload, but only when teams trust and use it. Training costs include onboarding compliance teams, updating workflows, and aligning policies with AI-driven controls.

Conversational AI for compliance management plays a major role here. It lowers learning curves and improves adoption across non-technical teams.

5. Ongoing Governance and Model Oversight

AI systems require monitoring to ensure accuracy, fairness, and regulatory alignment. This includes audit logs, explainability features, and regular validation.

With upcoming AI regulations in the EU, UK, and APAC expected to tighten through 2026, governance is no longer optional.

How to Calculate AI Compliance ROI Properly

Step 1: Establish Your Baseline Costs

Start with current compliance spend:

- Staff hours per audit cycle

- External consultant fees

- Penalties and remediation costs

- Time-to-audit readiness

This baseline makes AI compliance ROI measurable and defensible.

Step 2: Quantify Automation Impact

AI-driven audit automation typically reduces manual effort by 50 to 80 percent. According to McKinsey, AI-enabled compliance functions report up to 60 percent faster audit preparation times.

Calculate savings from:

- Reduced headcount dependency

- Faster onboarding and controls testing

- Lower error-related rework

Step 3: Measure Risk Reduction and Accuracy Gains

This is where AI delivers outsized value. Predictive risk analytics identify issues before they escalate. Continuous monitoring replaces periodic checks.

PwC reports that organizations using AI for regulatory compliance automation see up to 30 percent fewer compliance incidents within the first year.

Reduced risk equals reduced cost, even if it does not appear on a balance sheet.

Step 4: Account for Time-to-Value

Most modern AI compliance platforms deploy within weeks, not months. Organizations typically begin seeing measurable cost savings within 3 to 6 months.

Faster ROI matters. Especially in regulated industries where delays increase exposure.

The Impact of AI Automation on Compliance Costs

By shifting from manual to AI automation compliance models, organizations report:

- 50 to 90 percent reduction in operational compliance costs

- Faster audits with fewer findings

- Improved regulatory confidence across jurisdictions

- Better alignment with security and data governance standards

Deloitte predicts that by 2026, over 70% of compliance teams in financial services will rely on AI-driven risk monitoring as a core capability.

Final Thoughts

Calculating AI automation compliance costs requires more than vendor pricing. True ROI comes from understanding the total cost of ownership, avoiding hidden expenses, and measuring risk reduction alongside efficiency gains.

When implemented correctly, AI compliance automation pays for itself quickly. It cuts costs, improves accuracy, and future-proofs organizations against regulatory change.

For compliance leaders, the question is no longer whether AI is affordable. It is whether manual compliance still is.

Take the Next Step with PiTech

PiTech’s AI-driven compliance solutions streamline monitoring, audit preparation, and risk management, cutting manual effort by up to 80% while boosting accuracy and regulatory confidence.

Whether you’re looking to accelerate onboarding, reduce false positives, or implement continuous monitoring, PiTech provides a scalable, fully integrated solution that helps your compliance teams work smarter, not harder. Start your journey to faster, cost-effective, and future-ready compliance with PiTech today.

Key Takeaways

- Rising Compliance Costs: Manual compliance is labour-intensive, error-prone, and slow, consuming up to 10% of operating budgets.

- Hidden Manual Costs: Delays, rework, team fatigue, scalability challenges, and risk of penalties inflate operational costs.

- AI Automation Cost Factors: Include software licensing, system integration, data preparation, training, and ongoing governance.

- Integration Complexity: Costs rise with legacy systems and fragmented data; clean APIs reduce effort.

- ROI Calculation: Measure baseline costs, automation impact, risk reduction, and time-to-value to assess true ROI.

- AI Benefits: Reduces manual effort by 50–80%, accelerates audits, improves accuracy, and lowers compliance incidents by up to 30%.

- Implementation Caution: Avoid over-customization, poor vendor support, shadow IT, and lack of explainability to realize full benefits.

Frequently Asked Questions (FAQs)

How do you calculate ROI for implementing AI automation in compliance?

What are the hidden costs when automating compliance processes with AI?

- Data preparation and cleansing

- Ongoing governance and monitoring

- Shadow IT or workarounds if adoption is low

How long does it take to see cost savings in AI-driven compliance automation?

What are typical mistakes in budgeting AI compliance automation projects?

Common mistakes:

-

Underestimating integration and data preparation costs

- Ignoring training and change management needs

- Over-customizing AI solutions

- Failing to account for shadow IT or hidden manual work

How to measure risk reduction and compliance accuracy improvements with AI?

- Track the number and severity of compliance incidents before and after AI deployment

- Measure audit completion times and error rates

- Monitor adherence to regulatory requirements

- Evaluate time saved on manual reviews and rework reduction

-

Use KPIs such as incident reduction %, process efficiency gains, and coverage improvements