Table of Contents

Summarize and analyze this article with

Introduction

Why Capital Markets Are Turning to Agentic AI

Agentic AI solves a real problem :

- Continuous investment research instead of periodic analysis

- Faster portfolio rebalancing during volatile markets

- Real-time risk aggregation across asset classes

-

Automated audit trails for compliance teams

Is Agentic AI Really Better Than Traditional AI?

For example, an autonomous AI trading agent does not just generate a signal. It evaluates market impact, checks exposure limits, validates compliance rules, coordinates with execution systems, and adapts if conditions change mid-cycle.

That level of autonomy cannot be hard-coded. It must be learned, governed, and supervised.

This is why firms are moving toward multi-agent systems finance architectures, rather than scaling one large model.

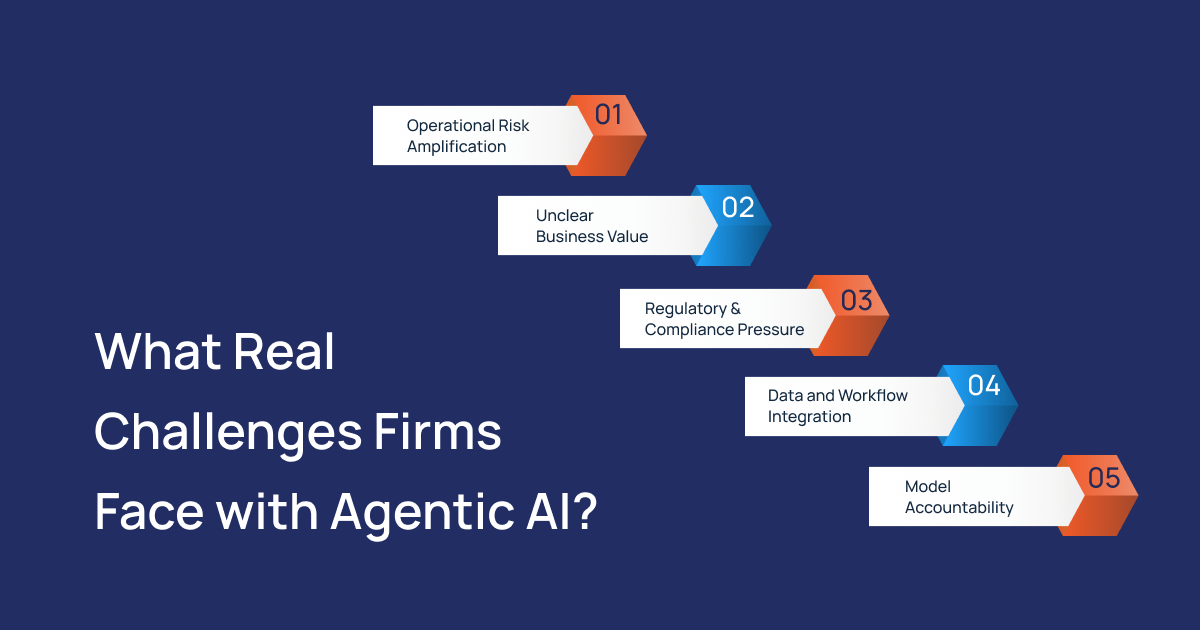

What Real Challenges Firms Face with Agentic AI?

1. Operational Risk Amplification

2. Unclear Business Value

3. Regulatory and Compliance Pressure

4. Data and Workflow Integration

5. Model Accountability

How to Build a Strong Foundation for Agentic AI

Start With Domain-Adapted Agents

Design for Orchestration

Embed Risk Management by Design

Prioritise Explainability

Scale Securely

What Outcomes Firms Are Seeing

- Investment research cycles shortened by up to 50 percent

- Portfolio optimization improved through continuous scenario testing

- Compliance teams gained real-time visibility into automated decisions

- Technology costs stabilised as workflows scaled without linear headcount growth

Transform Capital Markets Operations with PiTech’s Agentic AI

PiTech helps financial institutions harness the full potential of agentic AI by turning complex, multi-step investment workflows into coordinated, autonomous, and risk-aware operations. From real-time research and portfolio management to continuous risk monitoring and compliance, our multi-agent systems enable faster, smarter decisions while reducing operational errors.

Discover how PiTech’s agentic AI solutions deliver:

- Continuous investment insights and faster portfolio rebalancing

- Real-time risk aggregation across assets

- Automated, auditable compliance trails

- Improved operational efficiency without linear cost growth

Key Takeaways

- Multi-step workflows : Agentic AI coordinates specialized agents for research, execution, risk, and compliance in real time.

- Orchestration over isolation : Unlike traditional AI, multi-agent systems manage complex, interdependent decisions across markets and operations.

- Foundation matters : Embedding orchestration, auditability, and risk management prevents error cascades and regulatory breaches.

- Domain-adapted agents : Training agents with financial data and regulatory context reduces errors and improves decision relevance.

- Explainability is critical : Transparent agent actions build regulatory compliance and trust with investment committees.

- Measurable impact : Faster decisions, up to 50% quicker research cycles, better portfolio optimisation, and real-time compliance visibility.

- Infrastructure, not experiment : Properly implemented agentic AI delivers efficiency, risk reduction, and competitive advantage.