Table of Contents

Summarize and analyze this article with

Introduction

Why AI Implementation and Strategy Matter in Banking

In banking, AI helps with better customer service, sharper risk detection, and more efficient operations. According to a recent study, most of the banks recognize these AI benefits, but only a handful are able to harness their true potential.

A robust AI strategy should address three main things:

- It should centre around business outcomes such as growth, cost control, and risk reduction rather than technology for technology’s sake.

- It must address how to embed and scale instead of just stopping with a pilot launch.

- The strategy of AI transformation must also have the capability to operate the new systems reliably and responsibly

It is estimated that generative AI alone can add an additional $200 to $340 billion in annual value for the banking industry. However, this edge is for the banks that build the right infrastructure, governance, and talent to support it. Simply put, banks that treat AI as a peripheral experiment may miss out on real value, while those that adopt a structured, enterprise-wide AI roadmap can transform how they create it.

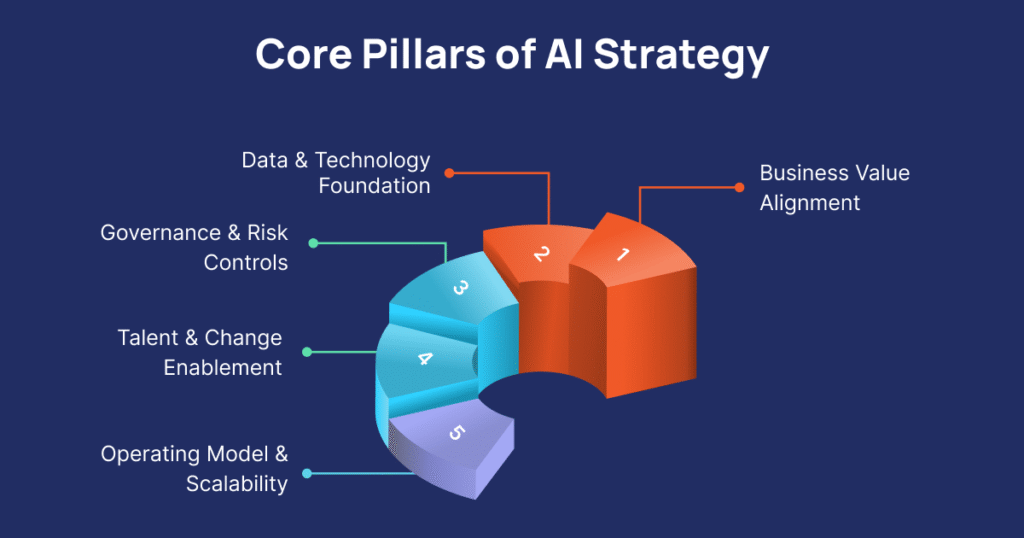

5 Core Pillars of a Winning AI Strategy

1. Business Value Alignment

Anchoring AI efforts in business goals is a sound AI strategy. Identify key use cases where AI can realistically impact revenue, cost, risk, or customer retention. Just building models won’t be enough, and they must be tied to clear metrics for delivering the flows of impact. Credit underwriting, fraud detection, cross-sell/upsell campaigns, and customer-service automation are a few of the high-value use cases in banking.

Research shows that banks prioritizing sub-domains with high business impact and technical feasibility tend to capture most of the value. Hence, banks can build confidence and momentum to scale by choosing use cases strategically and tracking the defined KPIs.

2. Data & Technology Foundation

-

A unified view of customers and operations must be created by integrating all available data.

- The technology stack must support APIs, cloud or hybrid systems, real-time processing, and ML/deployment pipelines.

-

An operational platform for monitoring, versioning, drift detection, security, and compliance.

- Scalable infrastructure to reuse the components or models that worked instead of reinventing them every time.

With this kind of strong foundation, banks can have a truly enterprise-wide AI integration.

3. Governance and Risk Controls

In a highly regulated industry like banking, credit scoring to trading must be explainable and auditable. Hence, AI governance is a must to ensure transparency, compliance, and accountability.

Robust governance frameworks define who owns AI outcomes, how data is used, and how models are validated. Financial regulators increasingly expect banks to maintain model risk management practices similar to those used for traditional models.

A comprehensive AI governance framework should include:

- Clear data lineage and ownership tracking

- Continuous model monitoring for bias, drift, and accuracy.

- Documented approval processes and human oversight.

- Alignment with regulatory standards such as BCBS-239, GDPR, and emerging AI governance policies.

Effective governance does not slow innovation, but it provides structure and trust, enabling safe scaling of AI solutions across divisions.

4. Talent and Change Enablement

Every transformation is dependent on human involvement. So, banks must cultivate multidisciplinary teams combining data scientists, machine learning engineers, risk managers, and business domain experts.

Moreover, creating awareness across the organization is very important for everyone to work towards a common goal. Many AI projects underperform because employees see them as technology replacements rather than capability enhancers.

Establishing AI literacy programs and embedding “human-in-the-loop” mechanisms helps employees understand their role in the new workflow.

Leadership support also plays a decisive role. When senior executives champion the AI transformation, it sends a message that this is a strategic priority, not a side experiment.

5. Operating Model and Scalability

Once the foundation is ready, banks need a scalable operating model that connects AI experimentation with enterprise execution. The most mature institutions follow a hub-and-spoke model — a centralized AI center of excellence (CoE) sets standards, while business units execute use cases aligned with those standards.

Key features of a scalable model include:

- Standardized templates for model development and deployment.

- Central repositories for reusable components and datasets.

- Clearly defined accountability for data ownership and use-case delivery.

- Feedback loops between business and technical teams to ensure measurable outcomes.

When structured well, this model reduces duplication and accelerates rollout across multiple functions — lending, fraud management, marketing, and customer service.

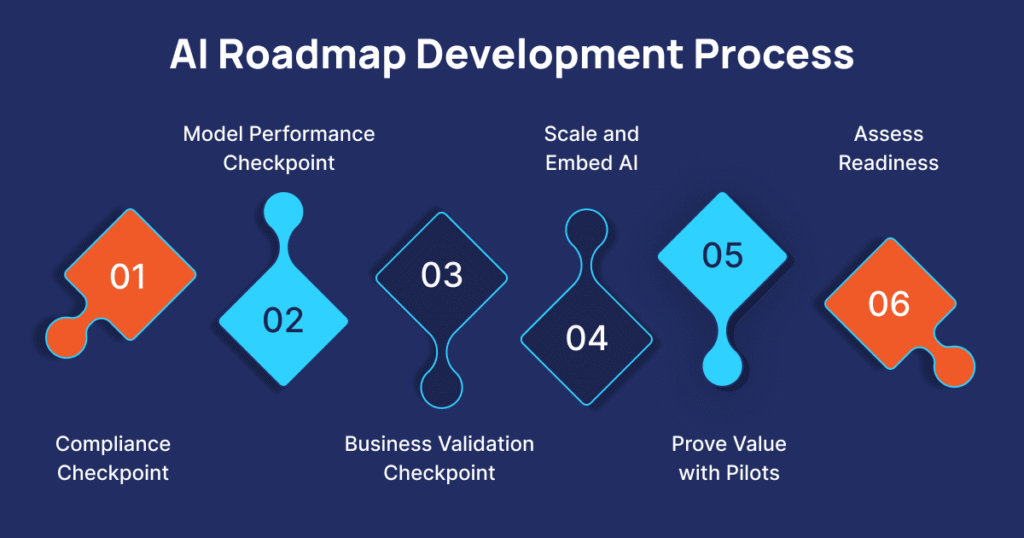

Build the Roadmap

A well-defined AI roadmap turns vision into real outcomes. It typically unfolds in three stages:

- Assess Readiness: Evaluate current data, infrastructure, skills, and regulatory preparedness. Identify the baseline maturity of the bank’s AI capabilities.

- Prove Value with Pilots: Select high-impact use cases with clear metrics (e.g., loan default prediction or automated KYC checks). Demonstrate measurable value before expanding.

- Scale and Embed AI Across Operations: Expand successful pilots across departments. Standardize architecture, documentation, and governance to ensure consistency and prevent fragmentation.

At each stage, the roadmap should include checkpoints for business validation, model performance, and compliance.

This step-by-step approach prevents scattered pilots and ensures they translate into measurable real-world impact.

Overcome Resistance

Cultural resistance remains one of the most underestimated barriers to AI adoption. In traditional banking environments, employees may fear automation or question AI’s reliability.

Change management requires communication, training, and transparency.

Banks can improve adoption by:

- Involving frontline teams early in use-case selection.

- Sharing success metrics from pilot programs to build confidence.

- Creating internal communities of practice to share learnings.

- Introducing incentive structures that reward data-driven decision-making.

When employees realize that AI helps them work smarter and boosts their productivity rather than replacing them, they embrace it faster and more willingly.

Real-World Examples of Enterprise AI Success

Across the banking landscape, real-world success stories illustrate the tangible value of AI:

- Risk modeling enhancement: A European bank integrated AI models into its lending process, reducing credit loss provisions by 10%.

- Customer engagement: A leading U.S. bank applied an LLM strategy for personalized advisory, increasing cross-sell rates by 30%.

- Fraud prevention: An Asian institution deployed hybrid ML-LLM systems, cutting fraud detection times from hours to minutes.

These outcomes highlight that with disciplined execution, AI delivers measurable operational and financial gains — regardless of bank size or geography.

Conclusion

As the banking landscape evolves, AI implementation & strategy will define which players lead the industry. From AI roadmap planning to enterprise AI deployment, success depends on aligning data, technology, and people. Banks that build resilience through AI adoption, change management, and business process automation will achieve measurable growth.

In 2026 and beyond, banks that treat AI as a long-term digital transformation enabler will benefit from sustained efficiency gains, stronger customer relationships, smarter decision-making, and a future-ready competitive edge in an increasingly data-driven financial landscape.

PiTech Solutions supports regional and mid-tier banks in planning and implementing AI transformation initiatives that comply with banking regulations and ensure defense-grade protection.

Key Takeaways

- Connect AI to Business Goals: Every AI initiative should clearly tie to revenue growth, cost efficiency, or risk reduction — not technology exploration.

- Lay the Right Foundations:Unified data, scalable infrastructure, and seamless integration are non-negotiable for enterprise AI success.

- Prioritize Governance and Trust:Responsible AI requires transparent operations, regulatory compliance, and clear ownership of outcomes.

- Empower People: Equip employees with skills and clarity so they see AI as a productivity partner — not a threat.

- Scale with Structure: Use repeatable frameworks and centralized oversight to expand successful pilots across business units efficiently.

- Lead with Vision: Executive sponsorship and a clear roadmap turn experimentation into measurable enterprise transformation.

Frequently Asked Questions (FAQs)

How do enterprises overcome resistance and manage change during large-scale AI rollouts?

Start by keeping people at the center. Explain why AI matters, not just how it works. Train teams early, highlight success stories, and make adoption rewarding. When employees see real benefits, change feels less like a threat and more like progress.

What does a practical, successful AI/LLM project deployment look like for non-tech-heavy sectors?

It’s all about starting small and scaling smart. Pick one problem with clear ROI — maybe automating compliance reports or enhancing customer service with LLMs. Once the pilot works, build on that success with strong governance and data practices.